U.S. stock index futures edged lower, major European stock markets (Germany, France, UK, Italy) were closed for holidays, and markets such as Australia and New Zealand were also shut. Trading in Asian stocks remained subdued, while Japan’s TOPIX index hit a new high. Metals resumed their upward trend, with gold, silver, and copper reaching new highs, while platinum and palladium also rose in tandem. Japan’s inflation declined more than expected, weakening the yen, while the South Korean won rebounded after official intervention, hitting its highest level since November.

Stock markets in multiple countries around the world were closed, resulting in light trading activity. After a brief correction yesterday, the metals sector collectively strengthened, with gold, silver, and copper prices continuing to reach new highs, while platinum and palladium also rose in tandem.

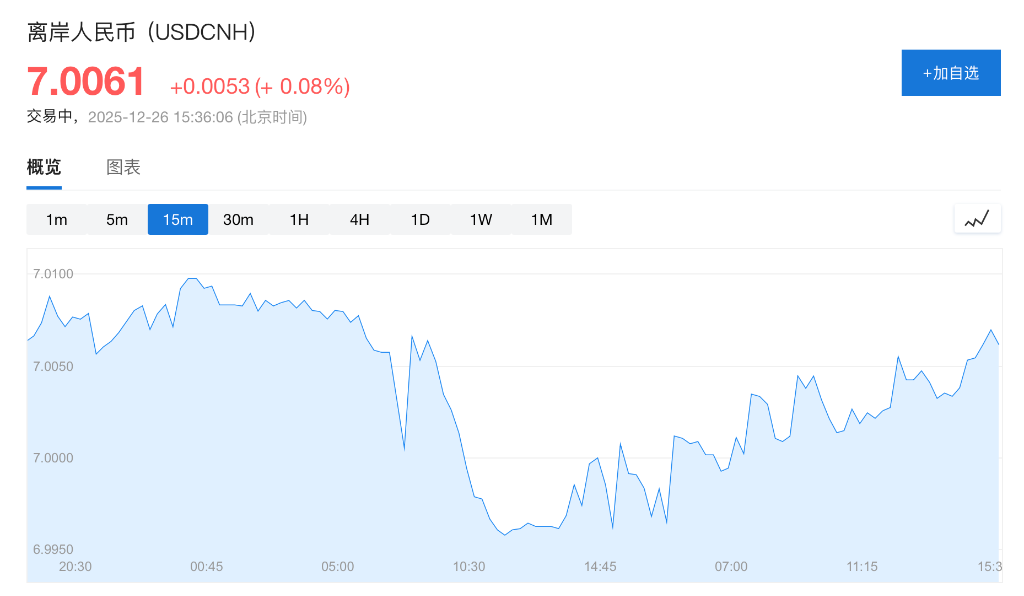

On December 26, U.S. stock index futures edged lower, major European stock markets (Germany, France, the UK, and Italy) were closed for holidays, and trading in Asian markets was subdued. Japan’s TOPIX index hit a new high, while markets in Australia and New Zealand were also closed. U.S. Treasury yields rose, while Japanese long-term government bond yields declined. The dollar edged up slightly, offshore yuan weakened modestly after breaking above 7, the yen depreciated slightly, and the Korean won rebounded to its highest level since early November. Metals and crude oil strengthened, and cryptocurrencies gained.

The broad-based rally in the metals market reflects deep investor anxiety about the macro environment and an urgent demand for physical assets. On one hand, expectations of Federal Reserve rate cuts and the sharp decline in the dollar reduced the cost of holding commodities; on the other hand, national security investigations into critical minerals, escalating sanctions on Venezuela, and geopolitical uncertainties in the Middle East and Africa significantly heightened risk aversion and hoarding intentions in the market.

The broad-based rally in the metals market reflects deep investor anxiety about the macro environment and an urgent demand for physical assets. On one hand, expectations of Federal Reserve rate cuts and the sharp decline in the dollar reduced the cost of holding commodities; on the other hand, national security investigations into critical minerals, escalating sanctions on Venezuela, and geopolitical uncertainties in the Middle East and Africa significantly heightened risk aversion and hoarding intentions in the market.

According to Wall Street News, Kelvin Wong, Senior Market Analyst at OANDA, stated:

“Since the beginning of December, momentum-driven and speculative behaviors have been propelling the rise in gold and silver prices. Factors such as year-end liquidity shortages, expectations of prolonged U.S. interest rate cuts, a weakening dollar, and escalating geopolitical risks have collectively driven precious metal prices to new highs. Looking ahead to the first half of 2026, gold prices may approach $5,000 per ounce, while silver prices could reach approximately $90 per ounce.”

The core market movements are as follows:

- Dow Jones Industrial Average futures fell 0.17%, S&P 500 futures dropped 0.03%, and Nasdaq futures remained largely unchanged.

- The Nikkei 225 Index closed up 0.7% at 50,750.39 points, Japan’s TOPIX Index rose 0.1% to close at 3,423.06 points, and South Korea’s KOSPI Index ended 0.5% higher at 4,129.68 points.

- The yield on the 10-year U.S. Treasury note rose 2 basis points to 4.15%.

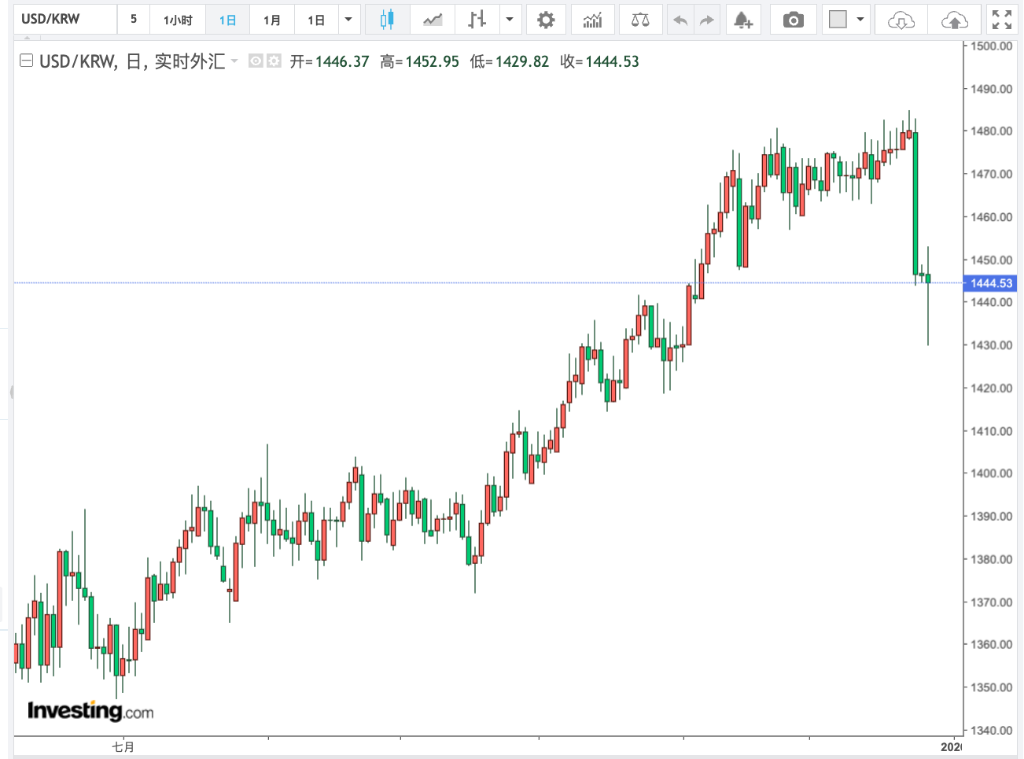

- The yen fell 0.2% against the dollar to 156.19, the offshore yuan exchange rate against the dollar remained largely stable at 7.0041, and the Korean won appreciated by 1.2% against the dollar to 1,429.85 at one point.

- Spot gold was trading at $4,510.54 per ounce, rising intraday to above $4,530 per ounce, setting another all-time high; spot silver traded at $74.62 per ounce, surpassing $75 per ounce to set a new record high; WTI crude oil increased nearly 0.3% to $58.52 per barrel.

- Bitcoin rose 1.3% to $89,020.81, while Ethereum increased by 1.1% to $2,976.44.

The offshore Renminbi is currently trading at 7.0061. Today’s central parity rate for the Renminbi against the US dollar was set at 7.0358, up by 34 points, marking the highest level since September 30, 2024. On Thursday, the offshore Renminbi broke above the psychological threshold of 7.0 for the first time since September 2024. According to Wall Street News, Zhaopeng Xing, a senior strategist at Australia & New Zealand Banking Group, stated that the signal conveyed by this central parity setting indicates that China’s central bank does not wish for the Renminbi to appreciate too rapidly. This aligns with the central bank’s recent commitment during its quarterly monetary policy meeting.

The Japanese yen ended its upward trend and softened slightly, with the yen-dollar exchange rate falling 0.2% to around 156.17. The decline in Japan’s inflation exceeded expectations, driven by easing pressure on food and energy prices, leading markets to anticipate that the Bank of Japan may delay interest rate hikes.

The South Korean won extended its gains from the previous day, with the won-dollar exchange rate rising 1.2% to 1,429.85, rebounding to its highest level since early November. This followed verbal interventions by South Korean authorities regarding the won’s recent weakness, as well as the announcement of a new package of tax measures aimed at stabilizing the foreign exchange market.

Driven by a weaker US dollar and investor bets on tightening global copper supply by 2026, Shanghai copper soared to a record high, while New York copper also saw gains.

WTI crude oil rose nearly 0.3% to $58.52 per barrel. Traders are closely monitoring the partial blockade of Venezuelan oil shipments by the United States and Washington’s military strikes against terrorist organizations in Nigeria.