Advertisement

Micron Technology: recent performance snapshot

Micron Technology (MU) has drawn investor attention after a sharp share price move, with the stock showing a 45% return over the past month and an 85% gain over the past 3 months.

See our latest analysis for Micron Technology.

The recent move sits on top of a strong run, with a very large 1 year total shareholder return and sizeable 3 year and 5 year total shareholder returns. At the same time, the latest 1 day share price decline of 4.8% to US$414.88 and a 7 day share price return of 3.81% suggest that momentum is still being tested in the short term.

If Micron’s surge has you looking beyond a single name, this could be a good moment to check out other high growth tech and AI stocks that are catching market attention.

With Micron now trading well above the average analyst price target and recent returns already very large, you have to ask: is there still mispricing here, or is the market already banking on years of future growth?

Most Popular Narrative: 38.2% Overvalued

According to the most followed narrative, Micron’s fair value of $300.21 sits well below the last close at $414.88, which creates a clear valuation gap that investors will want to understand.

What makes Micron interesting is its pivotal role in the AI supercycle. The company is perfectly positioned to capitalize on the insatiable demand for High-Bandwidth Memory (HBM), a high-margin product essential for training and deploying AI models. This structural shift has the potential to fundamentally change the company’s historical reliance on volatile consumer electronics markets.

Curious how a strong AI driven memory story ends up below today’s price? The narrative relies on faster growth, higher margins and a richer future earnings multiple. Want to see exactly which assumptions have to hold up for that $300.21 figure to make sense?

Result: Fair Value of $300.21 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this upbeat AI memory story can be shaken by classic chip cycle oversupply or by an escalation in US-China tensions that hits Micron’s sales.

Find out about the key risks to this Micron Technology narrative.

Another view on Micron’s valuation

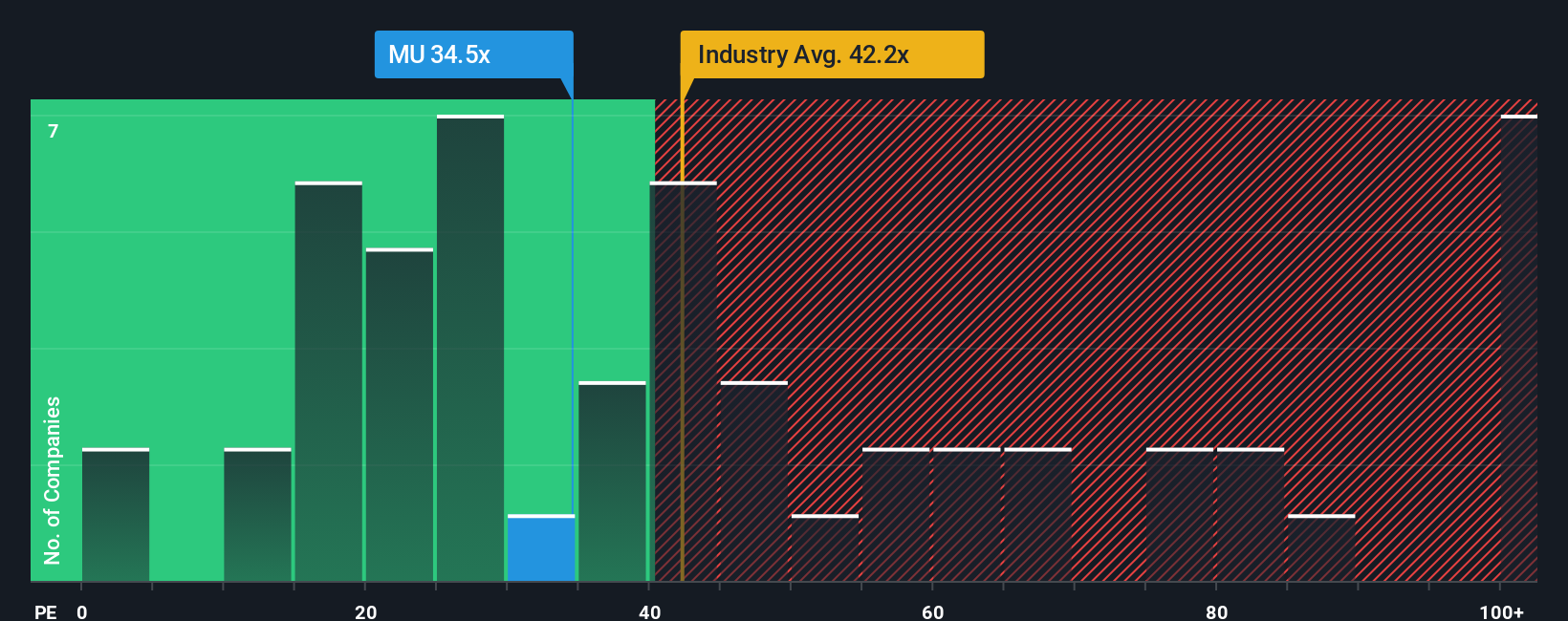

That user narrative points to Micron being 38.2% overvalued at $414.88 versus a $300.21 fair value. Yet on simple P/E, the picture is different. Micron trades at 39.2x earnings, below the US Semiconductor industry at 41.9x and well below peers at 64.8x, and under our 54.7x fair ratio. That mix of premium price and relative value begs a question: is the risk here in the story or in the starting point?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Micron Technology Narrative

If you see Micron differently or just want to test your own assumptions against the data, you can build a custom view in a few minutes: Do it your way

A great starting point for your Micron Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Micron has sharpened your interest, do not stop here. Use the Simply Wall St Screener to hunt for fresh ideas before the next move passes you by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com