- Cboe Global Markets (BATS:CBOE) is preparing to reenter event driven derivatives with regulated all or nothing options aimed at retail traders.

- The new contracts are designed to mirror binary style payouts while operating within securities rules.

- This move positions Cboe in direct competition with on chain platforms and prediction markets that focus on event based trading.

Cboe runs major options and equity exchanges, so its push into all or nothing options puts a large, regulated player directly into an area that has been growing through less regulated venues. For you as a retail trader, that could mean event based products offered through brokers you already use, rather than specialized prediction platforms. It also brings this style of trading into a framework that is more familiar to traditional market participants.

For investors watching BATS:CBOE, the key question is how much traction these contracts gain with active traders who are already comfortable with short term, event focused bets. The rollout and eventual trading activity may influence how other exchanges respond and whether more event driven products start to show up in mainstream options markets. This is likely to be a space where product design, regulation, and user experience matter as much as headline volumes.

Stay updated on the most important news stories for Cboe Global Markets by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Cboe Global Markets.

How Cboe Global Markets stacks up against its biggest competitors

Advertisement

Quick Assessment

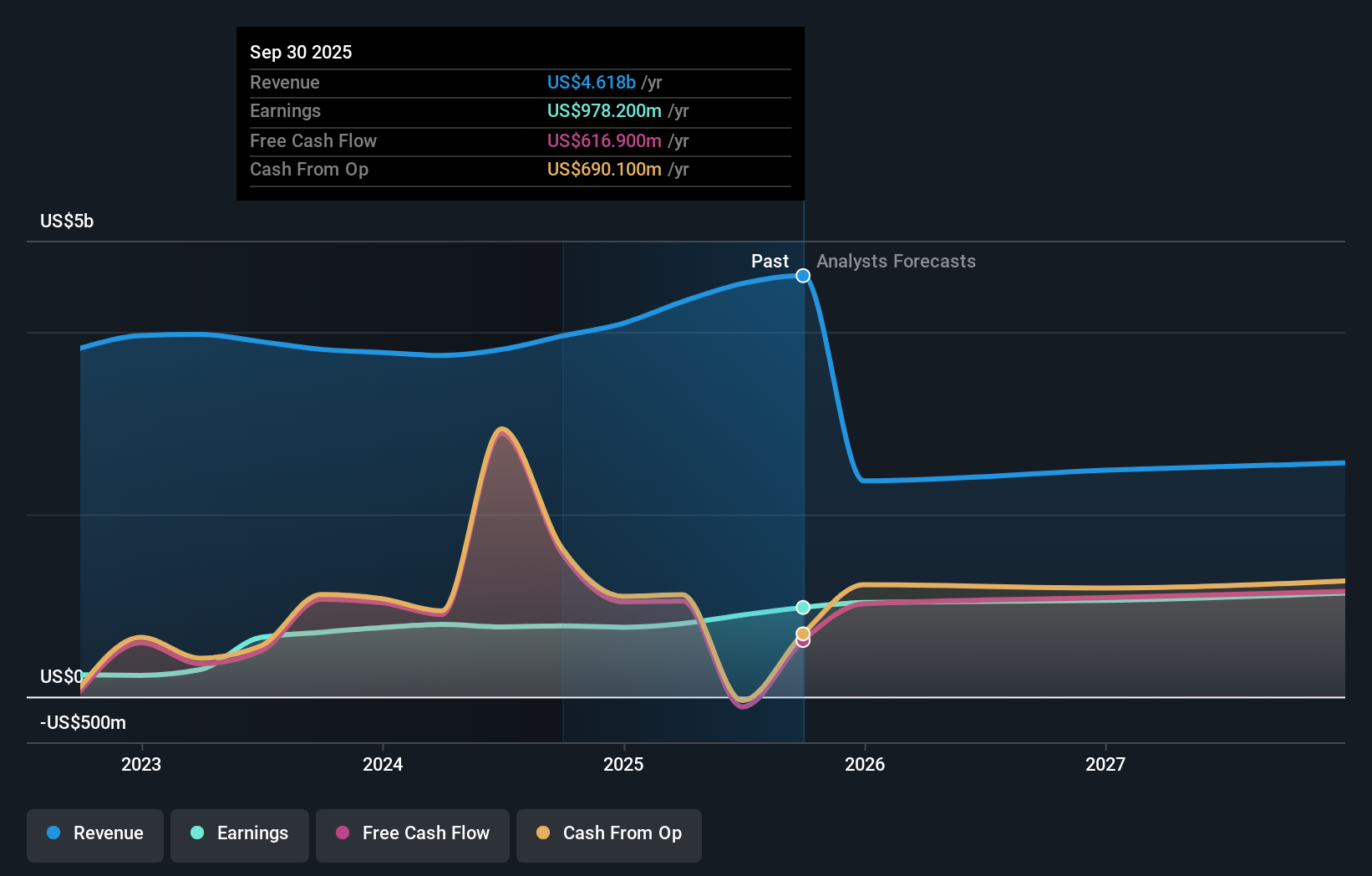

- ⚖️ Price vs Analyst Target: At US$275.28, Cboe trades about 0.8% above the US$273 analyst consensus target, which is very close to expectations.

- ❌ Simply Wall St Valuation: Shares are flagged as around 22.9% above estimated fair value, which suggests a rich valuation on this framework.

- ✅ Recent Momentum: The 30 day return of about 10.1% shows solid short term strength heading into this product launch.

Check out Simply Wall St’s

in depth valuation analysis for Cboe Global Markets.

Key Considerations

- 📊 All or nothing options could open a new fee stream if retail event trading flows onto Cboe’s regulated venues instead of staying on prediction platforms.

- 📊 Watch adoption metrics such as contract volumes, open interest and how much these products contribute beside Cboe’s existing P/E of 29.45 versus the capital markets peer average of 22.85.

- ⚠️ The main risk is that uptake is limited or regulators tighten rules on event contracts, which would leave investors paying a premium for growth that does not materialize.

Dig Deeper

For the full picture including more risks and rewards, check out the

complete Cboe Global Markets analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com