In recent weeks, global markets have experienced a mixed performance, with small-cap and value-oriented stocks gaining ground as investors shifted focus away from large-cap technology stocks amid concerns about artificial intelligence overinvestment. This environment highlights the potential for undiscovered gems in the market—stocks that may not be on every investor’s radar but possess strong fundamentals and growth potential, particularly in sectors currently benefiting from economic shifts.

Advertisement

Top 10 Undiscovered Gems With Strong Fundamentals Globally

NameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingToukei ComputerNA5.74%14.37%★★★★★★Dear LifeLtd73.27%19.01%13.67%★★★★★★Hoshi Iryo-SankiNA5.93%9.80%★★★★★★Muto Seiko34.82%9.10%30.87%★★★★★★E J Holdings25.78%4.84%1.57%★★★★★☆Nice78.50%1.97%13.44%★★★★★☆SpartaNAnannan★★★★★☆CMC1.00%2.80%7.26%★★★★★☆Changjiu Holdings50.46%54.90%14.57%★★★★☆☆PracticNA4.86%6.64%★★★★☆☆

Let’s dive into some prime choices out of from the screener.

Simply Wall St Value Rating: ★★★★★★

Overview: Lotus Holdings Co., Ltd. operates in China, focusing on the production and sale of condiments and health food, with a market capitalization of CN¥10.60 billion.

Operations: Lotus Holdings Co., Ltd. generates revenue primarily through the sale of condiments and health food products in China. The company’s net profit margin is 14%, reflecting its profitability within the industry.

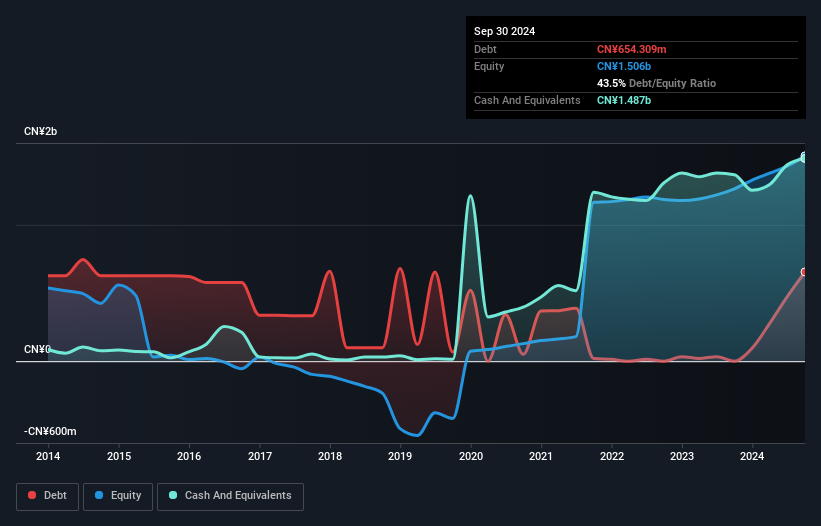

Lotus Holdings, a smaller player in its sector, has shown impressive earnings growth of 44.8% over the past year, outpacing the broader Food industry which grew at 3.7%. This growth is supported by high-quality earnings and a strong financial position where cash exceeds total debt. The company’s interest payments are comfortably covered with EBIT covering them 16.8 times over. Additionally, Lotus’s debt-to-equity ratio improved from 38.9% to 35% in five years, reflecting prudent financial management. With a price-to-earnings ratio of 36.5x below the CN market average of 49.1x, it presents an attractive valuation opportunity for investors seeking potential growth stories.

Simply Wall St Value Rating: ★★★★★☆

Overview: Darbond Technology Co., Ltd specializes in the research, development, production, and sale of polymer engineering and interface materials in China with a market cap of CN¥7.25 billion.

Operations: Revenue streams for Darbond Technology primarily come from the sale of polymer engineering and interface materials. The company’s cost structure includes expenses related to research, development, and production. Notably, the net profit margin has shown variability over recent periods.

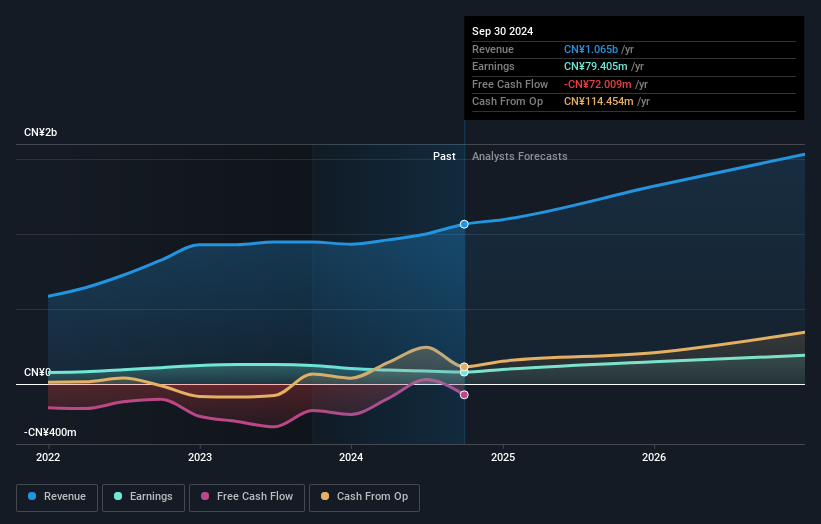

Darbond Technology, a nimble player in the market, has shown impressive earnings growth of 34% over the past year, outpacing the Chemicals industry’s 6.8%. Despite an increase in its debt to equity ratio from 3.3% to 8.4% over five years, it holds more cash than total debt, suggesting financial resilience. The company recently repurchased shares worth CNY 40 million as part of its buyback strategy initiated last April. With earnings forecasted to grow by another 30% annually and high-quality past earnings reported, Darbond seems poised for continued success in its sector.

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Jujie Microfiber Technology Group Co., Ltd. operates in the textile and clothing industry, specializing in microfiber products, with a market cap of CN¥6.54 billion.

Operations: Jiangsu Jujie generates revenue primarily from its textile and clothing business, amounting to CN¥565.20 million. The company’s financial performance is characterized by its cost structure and profit margins within this segment.

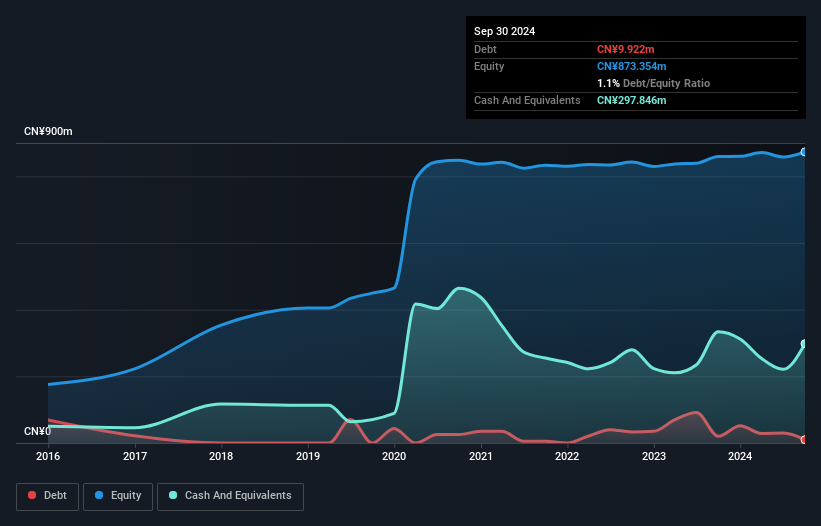

Jiangsu Jujie Microfiber Technology Group, a nimble player in the microfiber sector, has shown resilience with earnings growth of 1.8% over the past year, outpacing the luxury industry’s -1.2%. The company boasts high-quality past earnings and maintains a healthy financial position, with its debt to equity ratio dropping from 3% to 1.3% over five years. Despite recent share price volatility, it seems well-positioned for future growth with forecasts suggesting an annual earnings increase of 36.48%. A recent shareholders meeting indicates active engagement and strategic planning within the firm’s operations in Suzhou, China.

Taking Advantage

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com