- Moody’s upgraded Royal Caribbean Cruises’ credit rating, highlighting what it sees as strong earnings and financial discipline.

- Royal Caribbean updated its prohibited items policy, restricting certain smart glasses and tightening cybersecurity related rules onboard.

- The company cites passenger privacy and protection of ship operations as key reasons for the revised policy.

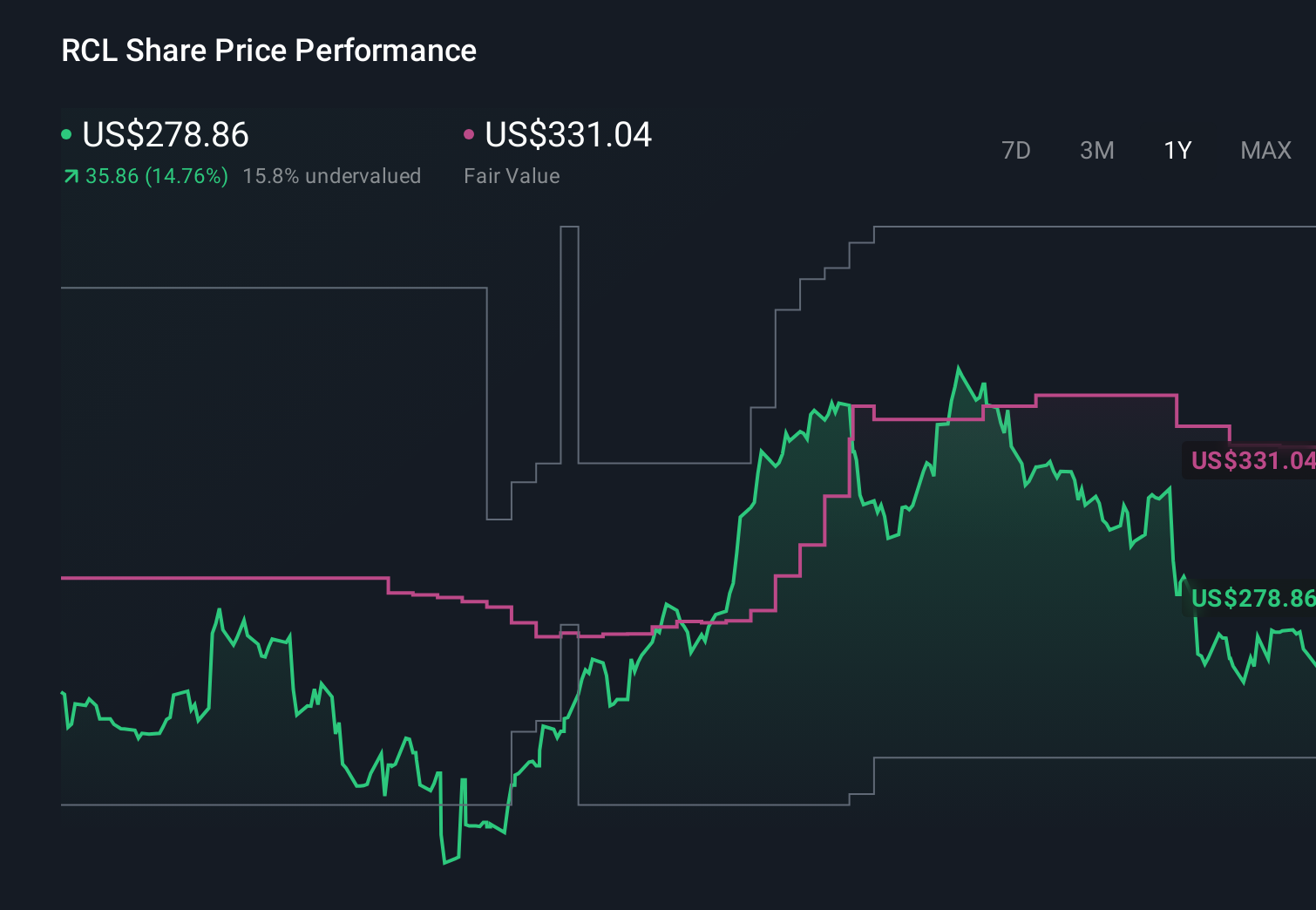

For investors watching NYSE:RCL, these updates come with the stock last closing at $319.61 and a value score of 4. The share price performance has been mixed in the short term, with a 1 week return showing an 8.2% decline, a 30 day gain of 14.4%, and a year to date return of 12.8%.

Moody’s decision to lift the credit rating and the privacy focused policy refresh both relate to how Royal Caribbean is managing financial and operational risks. For investors, this combination of credit profile changes and cybersecurity focus may be useful context when assessing how the company is positioned relative to other travel and leisure companies.

Stay updated on the most important news stories for Royal Caribbean Cruises by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Royal Caribbean Cruises.

For you as a shareholder or potential investor, Moody’s upgrade and the updated prohibited items policy sit alongside a wider set of capital and risk decisions. Royal Caribbean has just priced US$1.25b of 4.750% senior unsecured notes due 2033 and US$1.25b of 5.250% senior unsecured notes due 2038, with the stated aim of refinancing 2026 senior notes and other existing debt. Issuing longer dated, unsecured bonds at fixed coupons after a credit upgrade can signal that lenders are comfortable with the company’s balance sheet and cash generation profile. At the same time, the stricter approach to smart glasses and cybersecurity is about reducing the chance of operational or reputational shocks that could threaten that credit profile. Taken together with a higher quarterly dividend of US$1.50 per share and recent buybacks, the picture for investors is a company actively managing both sides of the equation: its capital structure and its operating risk, in a sector where peers like Carnival and Norwegian Cruise Line are also competing for both guests and investor confidence.

Advertisement

How This Fits Into The Royal Caribbean Cruises Narrative

- The refinancing of nearer term debt with 2033 and 2038 notes supports the narrative that the company is focused on maintaining a flexible balance sheet to underpin long term earnings growth from new ships and destinations.

- Higher fixed coupons, a larger dividend and ongoing ship investments could challenge the narrative if cash flows do not evolve in line with expectations, as that would make it harder to balance growth spending and shareholder returns.

- The tighter cybersecurity and privacy rules, including restrictions on certain smart glasses, are not a core feature of the existing narrative, yet they could be important for protecting onboard spending and brand perception over time.

Knowing what a company is worth starts with understanding its story.

Check out one of the top narratives in the Simply Wall St Community for Royal Caribbean Cruises to help decide what it’s worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Analysts have flagged that Royal Caribbean carries a high level of debt, so adding US$2.5b of new senior unsecured notes keeps leverage as a key point to monitor if conditions soften.

- ⚠️ Increased privacy and cybersecurity restrictions may create short term guest friction if not communicated well, and any incident that bypasses these controls could still affect operations and reputation.

- 🎁 The company is trading at 9.9% below one fair value estimate and is viewed as good relative value compared to peers, which some investors may see as support for taking on credit and operational risk.

- 🎁 Earnings grew 48.3% over the past year and are forecast to grow 10.71% per year, which, if achieved, could help support both the higher dividend, currently US$1.50 per quarter, and the enlarged debt stack.

What To Watch Going Forward

From here, it is worth keeping an eye on how Royal Caribbean executes on refinancing its 2026 maturities, including any early repayments of term loans using the new bond proceeds, and how credit agencies respond over time. Watch for commentary on onboard spend and booking trends versus peers like Carnival and Norwegian Cruise Line, as this will help you gauge whether the higher dividend and debt costs look sustainable. It is also useful to track any updates on onboard security incidents or guest feedback related to the new prohibited items policy, as this speaks to how effectively the company is managing operational risk alongside its more visible financial decisions.

To ensure you’re always in the loop on how the latest news impacts the investment narrative for Royal Caribbean Cruises, head to the

community page for Royal Caribbean Cruises to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com