Korea’s gaming industry is relearning a hard rule that glossy export narratives often hide. Product cycles, not brand legacy, decide who keeps strategic freedom. The 2025 results show a widening gap between studios that can ship globally relevant hits and those trapped in domestic softness or release gaps. What changes now is less about creativity and more about control: cash, cadence, and investor pressure.

Shift Up and Webzen, both mid-sized developers, moved in opposite directions. Shift Up posted 2025 revenue of KRW 294.2 billion and operating profit of KRW 181.1 billion, up 31.3% and 18.6% year on year, supported by Goddess of Victory: Nikke and Stellar Blade. Webzen reported 2025 revenue of KRW 174.4 billion and operating profit of KRW 29.7 billion, down 18.7% and 45.5%, as domestic weakness outweighed overseas growth.

At the top end, major publishers emphasized global execution as the next battleground. Nexon recorded KRW 4.5072 trillion in revenue and KRW 1.1765 trillion in operating profit, with a report attributing a fourth-quarter lift to Arc Raiders driving stronger North America and Europe sales.

Krafton posted KRW 3.3266 trillion in revenue and about KRW 1.0544 trillion in operating profit, with revenue up 23% while operating profit fell 11%. Netmarble reported record performance at KRW 2.8351 trillion in revenue and KRW 352.5 billion operating profit. NCSoft reported KRW 1.5069 trillion in revenue and KRW 16.1 billion operating profit, with reporting tying its rebound to the late-year performance of Aion 2.

Release gaps remained costly. Kakao Games turned to an operating loss of KRW 39.6 billion on KRW 465 billion revenue, while Pearl Abyss posted an operating loss of KRW 14.8 billion on KRW 365.6 billion revenue, with reporting linking the deficit to Crimson Desert not yet launching and noting a March 20 release date.

The reporting across multiple outlets converges on one mechanism: new titles decide performance, and global markets decide how long that performance can be defended.

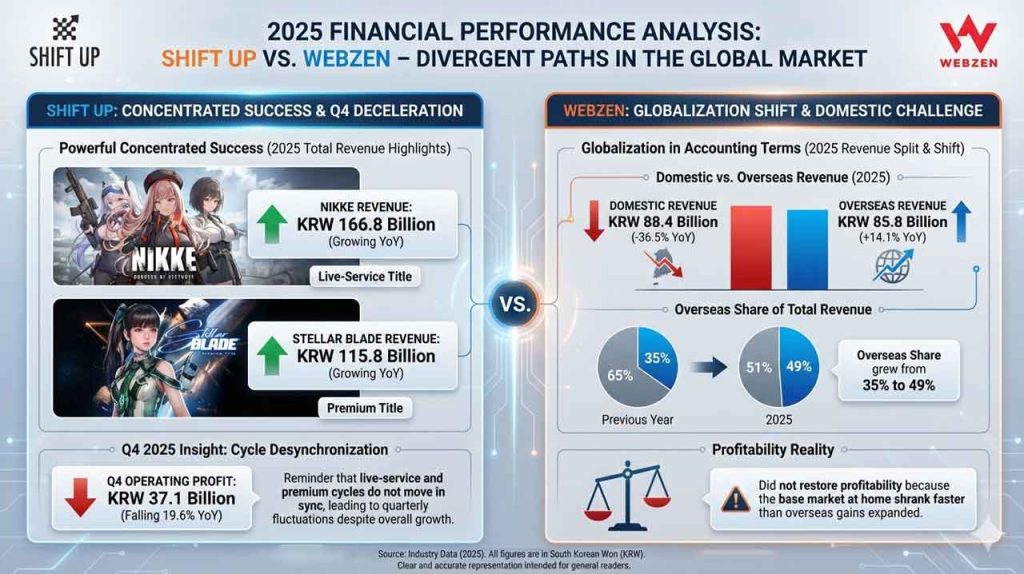

Shift Up’s numbers illustrate how concentrated success can still be powerful. In 2025, Nikke generated KRW 166.8 billion in sales and Stellar Blade generated KRW 115.8 billion, with both growing year on year. Yet even Shift Up showed fourth-quarter deceleration, with operating profit falling 19.6% to KRW 37.1 billion, a reminder that live-service and premium cycles do not move in sync.

Webzen’s results show the other side: overseas revenue rose to KRW 85.8 billion (+14.1%) but domestic revenue fell to KRW 88.4 billion (–36.5%). Overseas sales became 49% of total revenue, up from 35% a year earlier. That shift signals globalization in accounting terms, yet it still did not restore profitability, because the base market at home shrank faster than overseas gains expanded.

Meanwhile, large publishers are pairing global pipelines with financial discipline. One report notes Netmarble’s margin improvement was supported by company-wide cost efficiency. Another highlights Krafton’s ongoing content updates and collaborations as revenue drivers, while also describing plans to expand AI-enabled gameplay experiences.

A second trend surfaced alongside earnings: shareholder-return programs becoming more explicit and larger in scale.

Krafton CEO Kim Chang-han said the company would “enhance sustainable corporate value” by pursuing both shareholder returns and growth, citing cash holdings and stable cash generation.

Netmarble CEO Kim Byung-gyu said the company would continue “meaningful growth” as it sequentially rolls out eight new titles.

Webzen CEO Kim Tae-young said the company would strengthen its growth base by preparing new titles with completeness and differentiation, while continuing shareholder-return policies under the premise of financial stability.

These statements reflect the companies’ intent to reposition game studios as capital-market actors first, content makers second. The industry is signaling that patience will be priced, not assumed.

Based on these recent developments, two tensions are now visible in plain numbers.

First, hit concentration versus resilience. Shift Up’s performance shows strong execution on two IP pillars, but the fourth-quarter slowdown shows how quickly the slope changes when a cycle cools. This is a strategic risk when a studio is globally visible but still reliant on a narrow set of revenue engines.

Second, global revenue mix versus domestic drag. Webzen’s overseas share rising to 49% looks like internationalization, yet the company still posted steep declines in total revenue and operating profit. Global reach alone is not a cure if the portfolio cannot replace domestic erosion with new demand at meaningful scale.

The shareholder-return wave adds a third layer: investor discipline is now a product constraint. Large buybacks, dividend commitments, and share retirements raise the cost of missed launches. For well-capitalized publishers, that can function as a credibility signal. For mid-tier studios, it can quietly reduce risk appetite unless they have a clear new-title roadmap.

This is also where Korea’s ecosystem mechanics differ from the narrative in many policy discussions. The constraint is no longer only “creative risk.” It is the interaction between release cadence, platform expansion, and capital allocation under public-market scrutiny.

Reporting points to a common 2026 playbook: ship new titles, expand platforms, and pursue global markets.

Shift Up is aiming to deepen Stellar Blade’s position and develop next projects including Project Spirit. Webzen plans a global launch of the open-world action RPG Dragon Sword in the first half and is developing additional titles such as Gate of Gates, Project D1, and Terbis to diversify IP.

Major publishers are also stacking pipelines. Netmarble has outlined eight launches across the year. NCSoft plans global service for Aion 2 alongside additional new titles and M&A aimed at a mobile casual platform ecosystem. Krafton continues to prepare new releases while discussing AI usage inside gameplay and production.

The practical signal for global partners and investors is simple. Korea’s studios are not only competing on creativity. They are competing on reliability: the ability to launch, scale internationally, and still meet an increasingly explicit shareholder contract.

- Shift Up (2025): Revenue KRW 294.2B, operating profit KRW 181.1B; Nikke KRW 166.8B, Stellar Blade KRW 115.8B, but Q4 operating profit fell 19.6%.

- Webzen (2025): Revenue KRW 174.4B, operating profit KRW 29.7B; overseas revenue rose to KRW 85.8B yet domestic revenue fell to KRW 88.4B, pushing overseas share to 49%.

- Large publishers’ signal: Earnings reporting repeatedly ties performance to new-title success, and companies broadly describe global expansion as the 2026 priority.

- New ecosystem tension: Shareholder-return programs are expanding, raising the strategic cost of release gaps and making launch cadence a governance issue, not just a product issue.

- 2026 decision point: Studios that can ship globally relevant titles while keeping capital allocation credible will gain leverage; those relying on domestic recovery or delayed pipelines face shrinking room to maneuver.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.

Tags: Aion 2Arc RaidersAsia gaming marketCrimson Desertcross border game growthgame company dividendsgame industry profitabilityGaminggaming companiesglobal game publishingGoddess of Victory NikkeK gaming strategy 2026Korea console and PC expansionKorea game company earningsKorea game exportsKorea gaming trendsKorean game industryKorean gaming companiesKorean IP expansionKraftonNCSoftNetmarblenew game pipelineNexonPearl Abyssshareholder return policyShift UpStellar BladetrendsWebzen