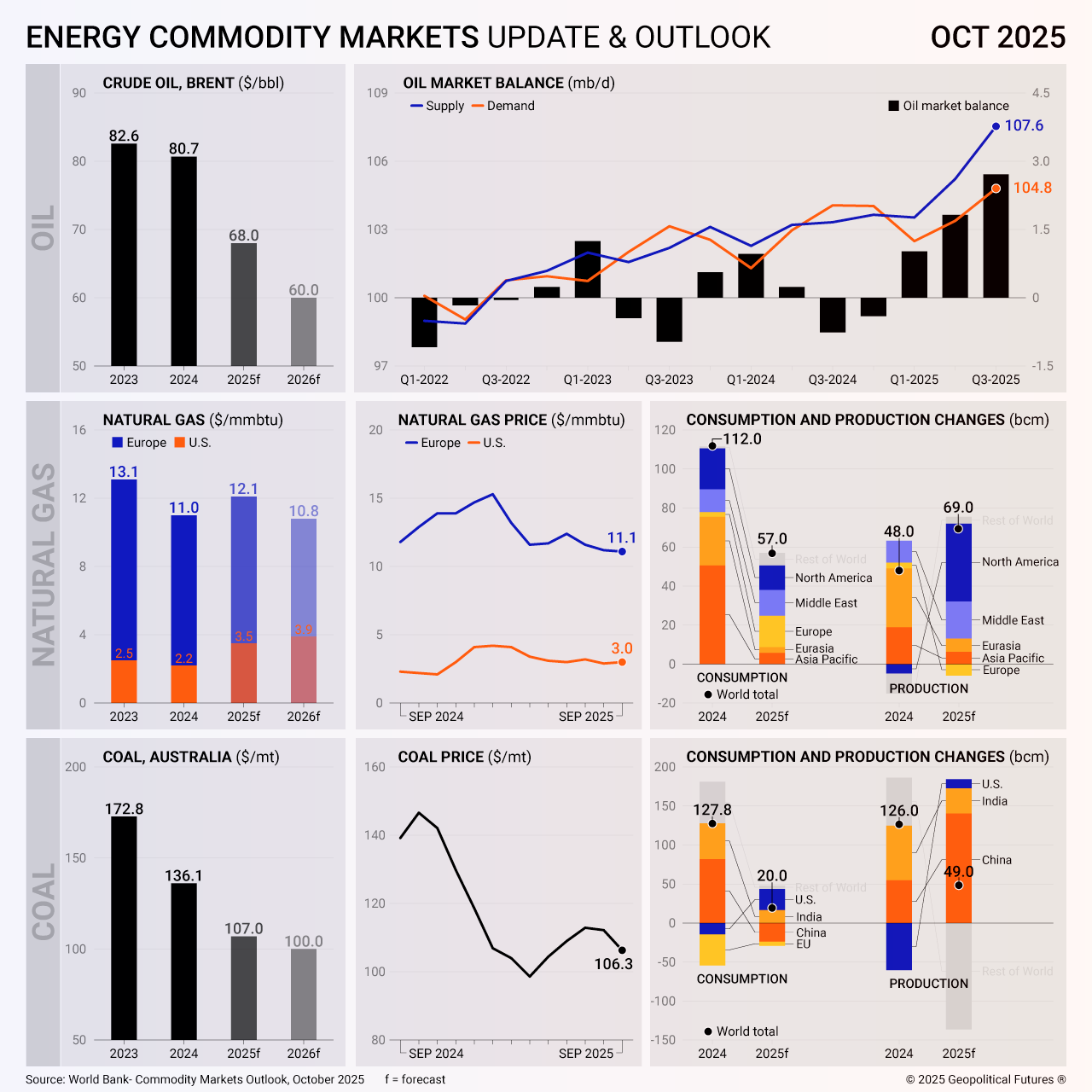

The World Bank predicts a widening imbalance between supply and demand in the energy market in 2026. Rising oil output, particularly from OPEC+ countries that are gradually restoring production volumes previously withdrawn under voluntary cuts, could exacerbate the glut and place additional downward pressure on prices. However, there is little reason to expect that rising supply will be met with equivalent demand. Global economic growth remains slower than expected, constrained by trade tensions and political uncertainty. China, a key energy consumer, is still experiencing a slowdown in purchasing, keeping demand subdued.

The World Bank expects this imbalance to further depress energy prices and forecasts that Brent crude will fall to its lowest level in five years in 2026. Many governments see lower energy prices as a tool to curb inflation and sustain economic growth and social stability – ongoing challenges for most economies. Yet, factors beyond supply and demand are increasingly influencing price dynamics. Uncertainty in trade policy and rising logistics costs could significantly affect market conditions. Continued geopolitical tensions and conflicts – along with expanded sanctions on one of the world’s largest energy producers, Russia, and the difficulty of quickly replacing Russian exports – could push oil prices above baseline forecasts.