Thailand’s cybersecurity sector has been growing steadily in recent years, reaching revenues of over $324 million. That promising growth has attracted both local and foreign investment, though some challenges remain.

Digitalization has been increasing in Thailand as high-speed internet, connected devices, and digital services like online banking have become the norm. Now, the country’s exposure to cybersecurity threats has also grown in parallel with this shift to digital.

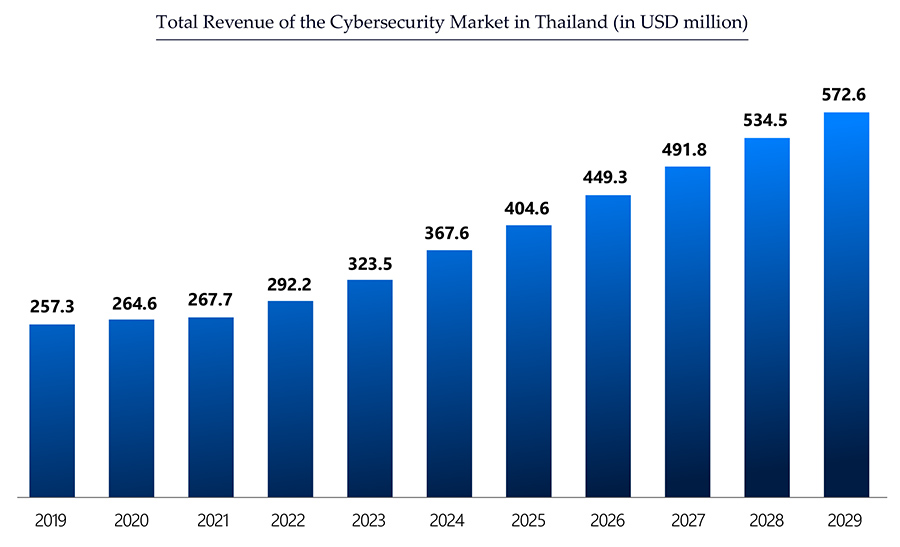

The cybersecurity industry in Thailand has been on a solid growth trajectory for several years now. A recent report from YCP suggests that revenue could reach up to $572.6 million in 2029 if the current growth rate of about 9.3% continues over the next few years.

Source: YCP

Cybersecurity threats in Thailand have been increasing significantly since at least around the time of the pandemic, when many businesses went online for the first time. Last year, there was a noticeable increase in the number of scammer calls and SMS messages.

Some of the key industry contributors to this growth have been banking and financial services, healthcare, retail, manufacturing, and the government sector. The need for cybersecurity services is clearly on the rise in Thailand – and the easiest (and cheapest) options for contracting these services will always be local providers.

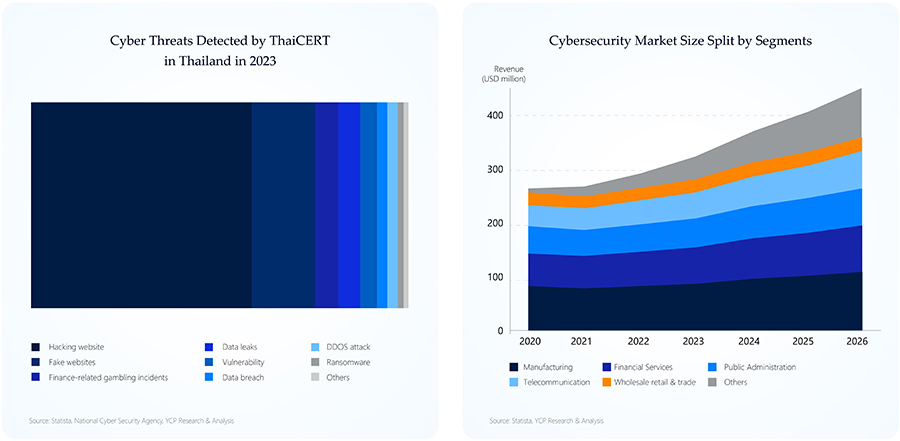

The study found that the manufacturing segment has invested the most in cybersecurity in recent years. Following close behind are the financial services, public admin, and telecom sectors. Banking and other financial services providers will be big in the continued growth of cybersecurity, as the Thai government pushed initiatives to ensure security against cybercrime.

“Cyber threats in Thailand heavily target educational institutions and government agencies, highlighting systemic vulnerabilities. Corporate entities and healthcare sectors also face growing risks, emphasizing the importance of tailored cybersecurity strategies across diverse industries,” according to YCP (a member of Nextcontinent).

Much like in other regions, companies are especially vulnerable to malware and phishing attacks, which represent 91% and 77% of all attacks in Thailand. The Thai government’s National Cyber Security Agency (NCSA) found that these incidents are mostly due to ineffective cybersecurity defenses and that 25% of SMEs lack proper security measures.

The largest cybersecurity employers in Thailand are foreign firms with a presence in the country, like IBM, Cisco, and others. There are, however, some homegrown rising stars, such as Cloudsec Asia and Red Sky Digital, both established in 2013 and based in Bangkok.

One of the main challenges this industry faces is a shortage of skilled cybersecurity professionals. This talent gap, highlighted by the NCSA in September 2023, is a significant obstacle to the nation’s cybersecurity goals and market growth.

With only 0.5% of civil servants in the IT sector and even fewer in cybersecurity, this deficit hampers the effective implementation of cybersecurity solutions. Most large Thai firms looking to contract cybersecurity services will have to look to companies headquartered in Japan, Singapore, America, or other countries with more established IT sectors – at least for now.

“While the market is competitive, there is still room for innovation, especially for small to medium-sized enterprises (SMEs) and specialized industries that are underserved by large players,” the YCP report notes.

“Local cybersecurity companies typically offer more competitive prices compared to international providers. This is because local providers have lower operational costs and can better tailor their services to the specific regulatory and business environment in Thailand.”