- Booz Allen Hamilton Holding (NYSE:BAH) is presenting at the NetDiligence Cyber Risk Summit.

- Company leadership is scheduled to speak on cyber risk, a key area of client focus.

- The event spotlights Booz Allen’s role in addressing cyber risk and security concerns.

Booz Allen Hamilton Holding, trading at $79.32, is stepping into a visible role at the NetDiligence Cyber Risk Summit, which puts its cyber expertise in front of a focused audience of clients and peers. For a stock that has seen a 30.9% decline over the past year and a 17.7% decline over the past 30 days, investors may be watching how the company presents its capabilities in a high priority area such as cyber risk. This kind of event can help you better understand where NYSE:BAH is currently concentrating its efforts.

For investors, the discussion at the summit can offer additional context around how Booz Allen thinks about cyber threats, client needs, and potential service expansion. While conference appearances do not directly translate into financial outcomes, they can shape perception, support existing relationships, and potentially open doors with organizations prioritizing cyber risk management.

Stay updated on the most important news stories for Booz Allen Hamilton Holding by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Booz Allen Hamilton Holding.

Advertisement

Quick Assessment

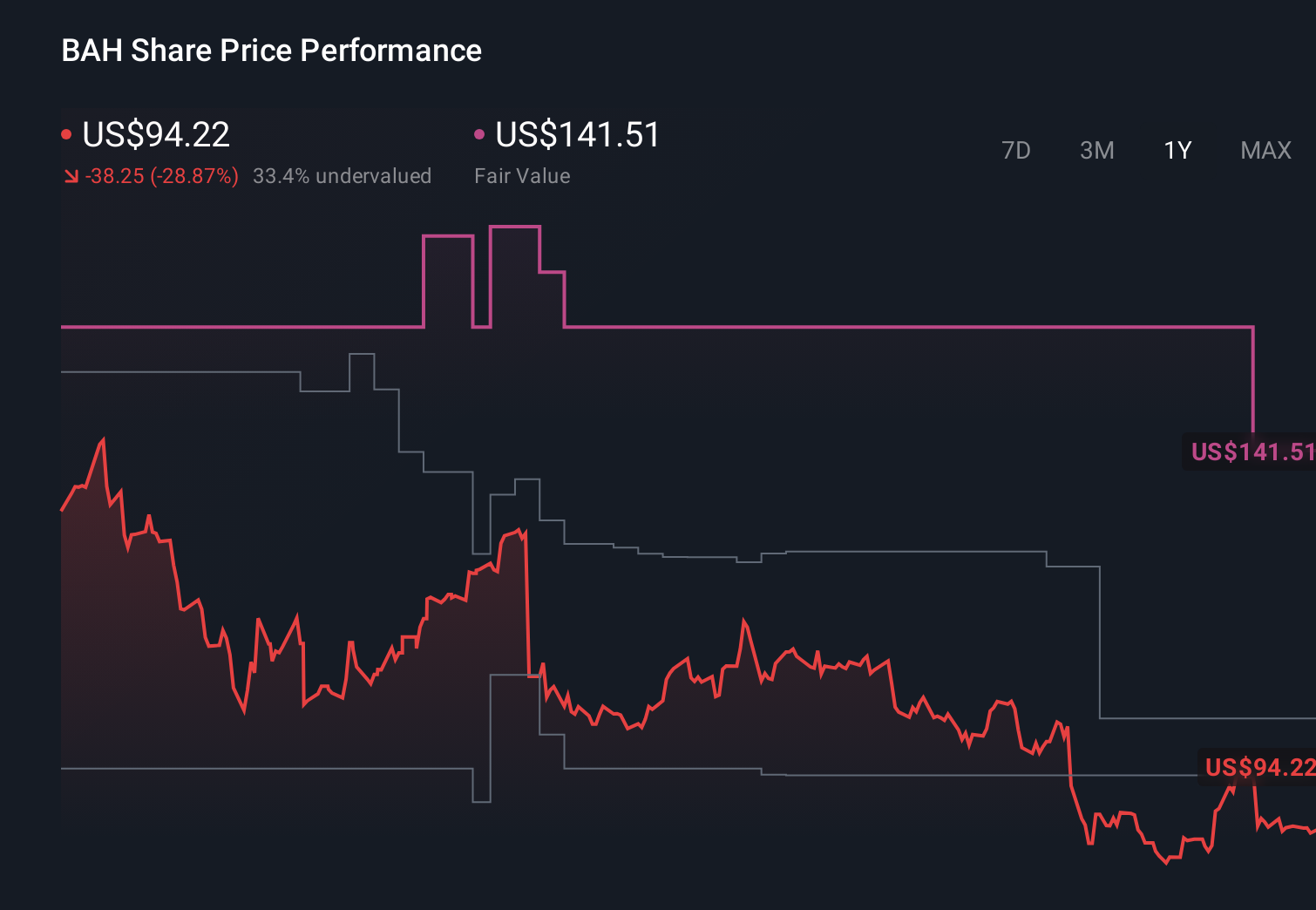

- ✅ Price vs Analyst Target: At US$79.32 versus an analyst target of US$106.82, the price sits about 26% below consensus.

- ✅ Simply Wall St Valuation: Shares are flagged as trading 51.4% below an estimated fair value.

- ❌ Recent Momentum: The stock has seen a 17.7% decline over the past 30 days.

There is only one way to know the right time to buy, sell or hold Booz Allen Hamilton Holding. Head to Simply Wall St’s

company report for the latest analysis of Booz Allen Hamilton Holding’s fair value.

Key Considerations

- 📊 The NetDiligence presentation puts Booz Allen’s cyber risk capabilities in front of a highly relevant audience, which may influence how clients view its role in security projects.

- 📊 With a P/E of 11.48 versus the Professional Services industry average of 19.40, some investors will watch whether events like this help sentiment catch up to valuations.

- ⚠️ Analysts expect earnings to decline by an average of 3.9% per year over the next 3 years, so it is worth checking if cyber-related work offsets that pressure.

Dig Deeper

For the full picture including more risks and rewards, check out the

complete Booz Allen Hamilton Holding analysis. Alternatively, you can visit the

community page for Booz Allen Hamilton Holding to see how other investors believe this latest news will impact the company’s narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Booz Allen Hamilton Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com