- Rubrik announced an expanded integration with the CrowdStrike Falcon cybersecurity platform, enabling advanced identity threat detection, real-time response, and recovery capabilities for organizations facing sophisticated identity-driven cyberattacks across hybrid environments.

- This partnership highlights Rubrik’s focus on unifying AI-driven data protection and cybersecurity, addressing the increasing enterprise demand for resilient identity security and rapid response to malicious threats.

- We’ll examine how Rubrik’s expanded CrowdStrike integration could impact its investment narrative by elevating its cybersecurity and identity resilience capabilities.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

Advertisement

Rubrik Investment Narrative Recap

To be a Rubrik shareholder, one needs to believe in the growing importance of integrated AI-powered data protection and identity security, as enterprises adopt hybrid cloud structures and face evolving cyber threats. The expanded CrowdStrike partnership meaningfully reinforces Rubrik’s differentiation in cyber resilience, but the key short-term catalyst remains execution on revenue growth and guidance, while the central risk is continued high expectations against an expensive valuation. The recent news does not materially shift these factors in the near term.

Among recent developments, Rubrik’s raised full-year 2026 revenue guidance to US$1,227 million–US$1,237 million stands out, supporting the company’s focus on scaling through product innovation and partnerships like CrowdStrike. This uptick in expectations highlights the importance of delivering on operational execution as investors weigh potential upside against inherent risks tied to growth assumptions.

However, in contrast to product traction, investors should pay close attention to ambitions that involve predicting forward growth…

Read the full narrative on Rubrik (it’s free!)

Rubrik’s narrative projects $2.0 billion revenue and $257.3 million earnings by 2028. This requires 26.2% yearly revenue growth and a $782.1 million earnings increase from current earnings of -$524.8 million.

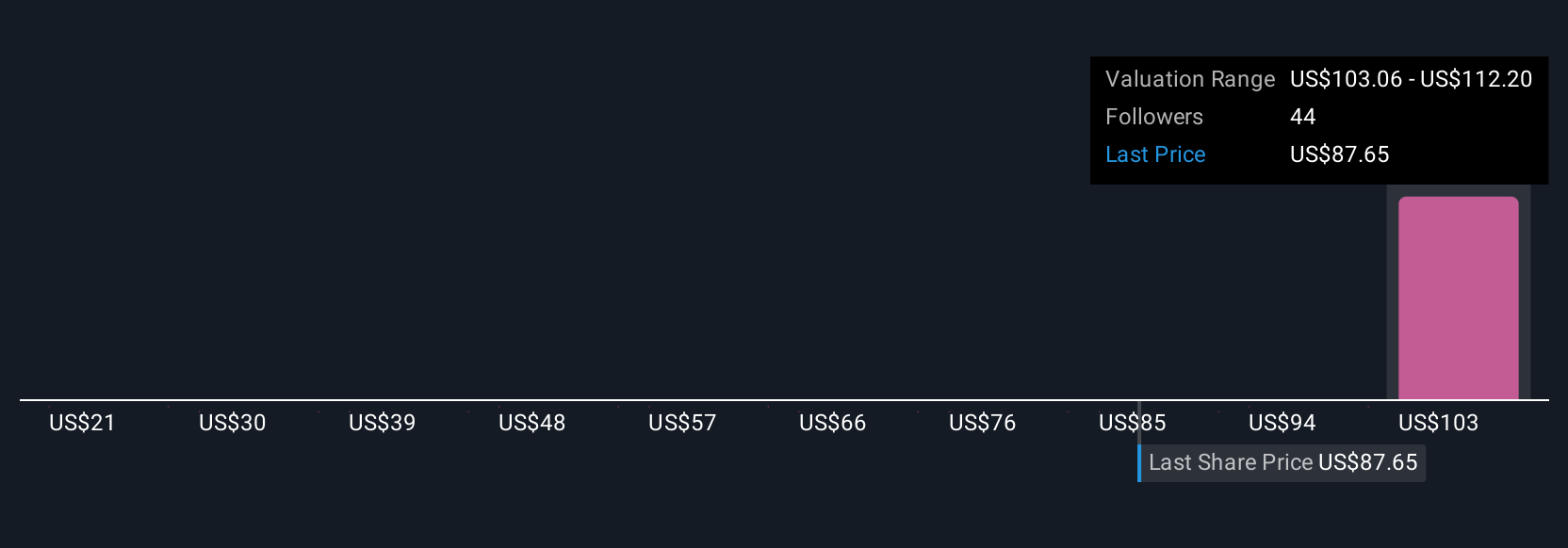

Uncover how Rubrik’s forecasts yield a $115.20 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community range from US$20.21 to US$115.20, reflecting broad differences in growth expectations. As many await Rubrik’s next move, aggressive competition in cyber resilience continues to shape possible outcomes for the company’s future performance.

Explore 9 other fair value estimates on Rubrik – why the stock might be worth less than half the current price!

Build Your Own Rubrik Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rubrik research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rubrik research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Rubrik’s overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com