- In early November 2025, the U.S. Air Force Life Cycle Management Center’s Cryptologic and Cyber Systems Division announced it awarded Maximus a new Joint Cyber Command & Control Readiness contract, valued up to US$86 million, to advance interoperability and deliver engineering and cybersecurity solutions over a multiyear period.

- This award further solidifies Maximus’s position as a critical government technology partner, expanding its footprint in defense-sector digital transformation and cybersecurity initiatives.

- We’ll examine how this expanded Air Force cybersecurity contract could influence Maximus’s investment narrative and future federal pipeline expectations.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Advertisement

Maximus Investment Narrative Recap

For shareholders in Maximus, the investment case hinges on the company’s ability to lead federal digital transformation and expand its presence in technology-driven government services. The recent US$86 million Air Force contract reaffirms Maximus’s credentials in cybersecurity, but does not materially alter the biggest short-term catalyst, which continues to be the rollout of new legislation and associated administrative demand, nor does it mitigate the major risk from potential reductions in large contract volumes due to increased automation or tightening government budgets.

Of the recent announcements, the July 2025 US$77 million Air Force cybersecurity and cloud contract stands out for its direct relevance to Maximus’s strengthening federal technology portfolio, reinforcing a growing pipeline in defense-sector IT and potentially supporting higher client retention and revenue visibility should related initiatives continue to expand.

However, it is important to remember that despite these wins, Maximus remains exposed to budget pressures and shifting procurement preferences, especially as government agencies…

Read the full narrative on Maximus (it’s free!)

Maximus’ outlook anticipates $6.1 billion in revenue and $486.5 million in earnings by 2028. This scenario relies on a 3.9% annual revenue growth rate and a $170 million earnings increase from the current $316.2 million.

Uncover how Maximus’ forecasts yield a $105.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

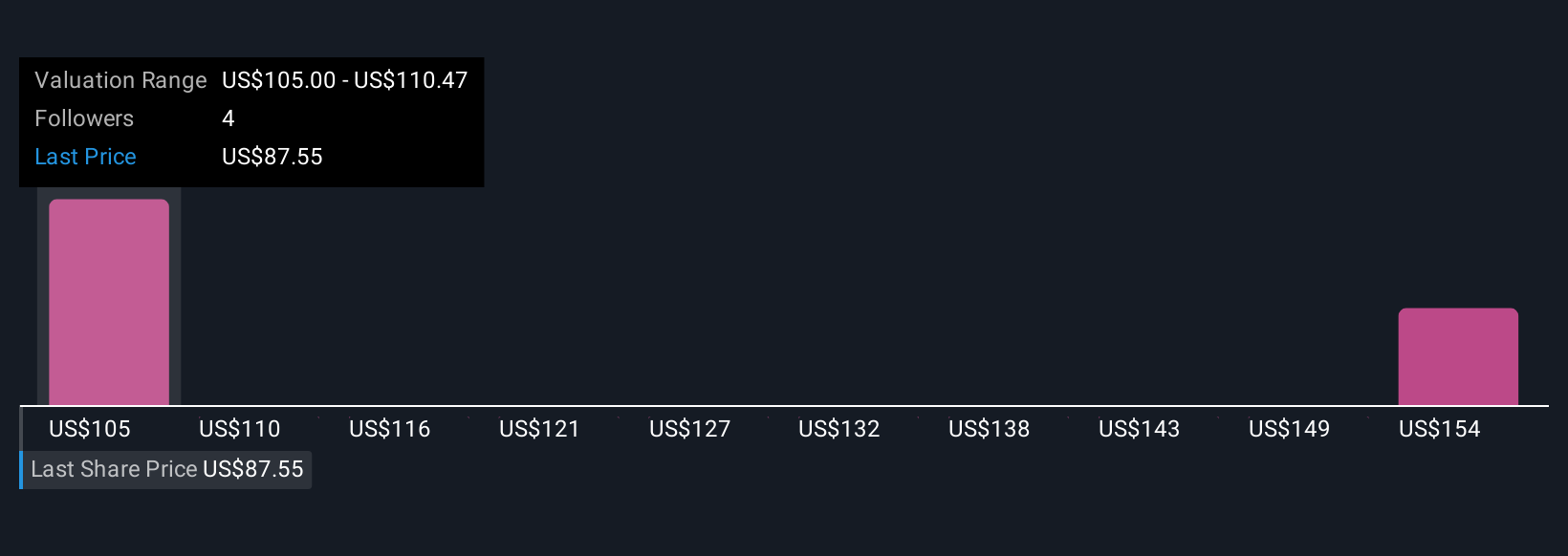

Retail investors in the Simply Wall St Community see Maximus’s fair value spanning US$105 to US$159, reflecting a wide range of confidence and expectations. As these views diverge, ongoing federal budget constraints remain a focal point that could alter the company’s forward earnings and contract volumes, consider a variety of outlooks when weighing your own position.

Explore 2 other fair value estimates on Maximus – why the stock might be worth as much as 90% more than the current price!

Build Your Own Maximus Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Maximus research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Maximus research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Maximus’ overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they’re targeting before they’ve flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com