- In early September 2025, Verisk Analytics reported Q2 results with revenue rising 7.8% year-over-year but net income dropping 17.7% amid higher operating costs and the absence of prior-year gains, alongside reports of exploratory talks to acquire cyber-risk analytics firm CyberCube and the launch of a Carbon Trust Assured Model for property claims in the UK.

- The company’s initiatives highlight a focus on expanding its data-driven risk management capabilities and supporting industry needs for advanced sustainability and cyber risk analytics solutions amid evolving insurance sector challenges.

- We’ll explore how margin pressures, as reflected in recent earnings and tied to higher costs, may impact the investment narrative for Verisk Analytics.

We’ve found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Advertisement

Verisk Analytics Investment Narrative Recap

To be a Verisk Analytics shareholder, you need to believe in the company’s ability to expand its position as a data and analytics partner to the global insurance industry, especially as risks such as cybersecurity and sustainability become core insurer priorities. While recent news of exploratory M&A talks and product launches demonstrates Verisk’s commitment to growth, margin pressure from rising operating costs remains the most important short-term challenge, outweighing any immediate effect these announcements may have on earnings trajectory.

The launch of Verisk’s Carbon Trust Assured Model for property claims in the UK stands out as a significant milestone, giving insurers advanced tools for measuring and reducing carbon emissions tied to claims. This development supports compliance and sustainability momentum across the sector and is relevant for those tracking catalysts tied to product innovation in response to regulatory and environmental imperatives. Yet, despite these advancements, investors should be mindful that…

Read the full narrative on Verisk Analytics (it’s free!)

Verisk Analytics’ narrative projects $3.9 billion revenue and $1.2 billion earnings by 2028. This requires 9.1% yearly revenue growth and a $290.7 million earnings increase from $909.3 million today.

Uncover how Verisk Analytics’ forecasts yield a $307.31 fair value, a 17% upside to its current price.

Exploring Other Perspectives

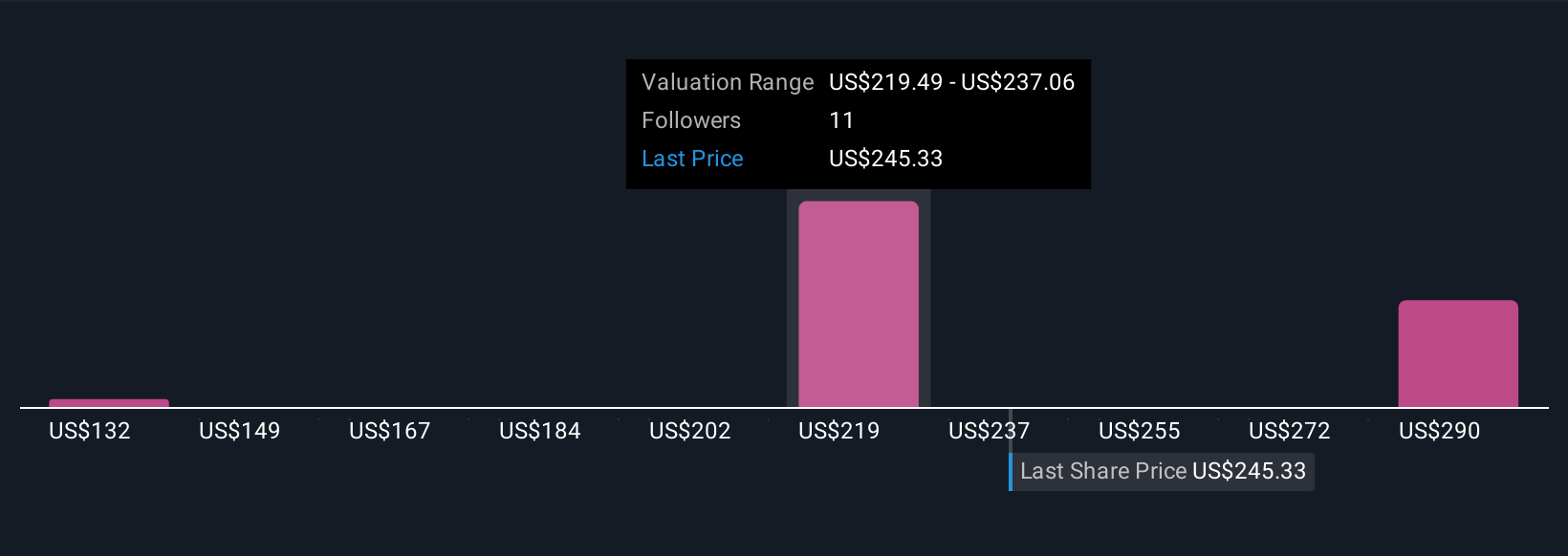

Four fair value estimates from the Simply Wall St Community range from US$131.67 to US$307.31 per share, reflecting broad differences among private investors. However, recent margin pressures and slowing earnings growth highlight risks that could influence future performance, so it’s worth comparing alternative viewpoints to your own expectations.

Explore 4 other fair value estimates on Verisk Analytics – why the stock might be worth 50% less than the current price!

Build Your Own Verisk Analytics Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verisk Analytics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verisk Analytics research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Verisk Analytics’ overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com