- The US Treasury Department terminated all contracts with Booz Allen Hamilton (NYSE:BAH) after a leak of sensitive tax information linked to work under its agreements.

- The contract terminations follow concerns around data protection and handling of confidential taxpayer data by a key federal contractor.

- Booz Allen has launched Vellox Reverser, an AI-driven malware analysis platform aimed at speeding up cyber threat detection and response.

- The new product highlights the company’s focus on cybersecurity solutions for both government and commercial clients following the Treasury action.

Booz Allen Hamilton, known for its consulting and technology work with US federal agencies and commercial clients, now sits at the center of two very different headlines. On one side, the Treasury contract terminations put a spotlight on data security expectations for large contractors. On the other side, the Vellox Reverser launch shows the company leaning into AI tools that focus on malware analysis and quicker threat assessment.

For you as an investor, these developments raise questions about Booz Allen’s future mix of federal and commercial business and how cyber offerings might factor into that. The key issues to watch include client reactions to the tax data incident, how the company responds to evolving security standards, and whether demand for AI based cyber tools like Vellox Reverser gains traction across its customer base.

Stay updated on the most important news stories for Booz Allen Hamilton Holding by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Booz Allen Hamilton Holding.

Is Booz Allen Hamilton Holding financially strong enough to weather the next crisis?

The Treasury contract terminations bring regulatory and reputational questions to the forefront for Booz Allen Hamilton, while the release of Vellox Reverser, an AI-powered malware analysis tool, shows the company trying to lean into its cyber expertise at the same time. For you, the key tension is whether the loss of Treasury work and tighter scrutiny on data controls weigh more heavily than the potential for higher value cyber projects with other federal agencies and commercial clients.

Advertisement

Booz Allen Hamilton Holding narrative, and how this fits in

The bullish and bearish narratives around Booz Allen already focus on its government-heavy revenue base, exposure to evolving security standards and its push into AI and cybersecurity, and this news sits directly in that intersection. Supportive views around national security strength and AI partnerships see products like Vellox Reverser as evidence that Booz Allen is trying to productize cyber capabilities, while cautious views point to the Treasury action as an example of how rising compliance expectations and contract scrutiny can pressure the civil portfolio.

Risks and rewards in focus

- ⚠️ Regulatory and legal risk could rise if investigations around the tax data leak lead to fines, additional oversight requirements, or restrictions on future Treasury or other civil work.

- ⚠️ Execution risk on cybersecurity and AI-powered products is meaningful, as federal buyers can compare Booz Allen with peers like Accenture and Leidos on both security track record and technical performance.

- 🎁 If Vellox Reverser gains traction with defense, intelligence, and commercial security teams, it could support higher margin, product-like revenue alongside traditional consulting work.

- 🎁 The focus on AI-centric cyber tools may help Booz Allen align with ongoing federal priorities around threat detection and resilience, which some analysts already view as a core strength.

What to watch next

From here, you may want to track any disclosure from Booz Allen on the financial size of the terminated Treasury contracts, whether new compliance commitments are required by other agencies, and how quickly Vellox Reverser is referenced on earnings calls or in new contract wins. If you want a wider range of viewpoints on how this could shape the long term story, take a look at community narratives and analyst takes on Booz Allen Hamilton and compare this news with your own expectations for its federal and cyber businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

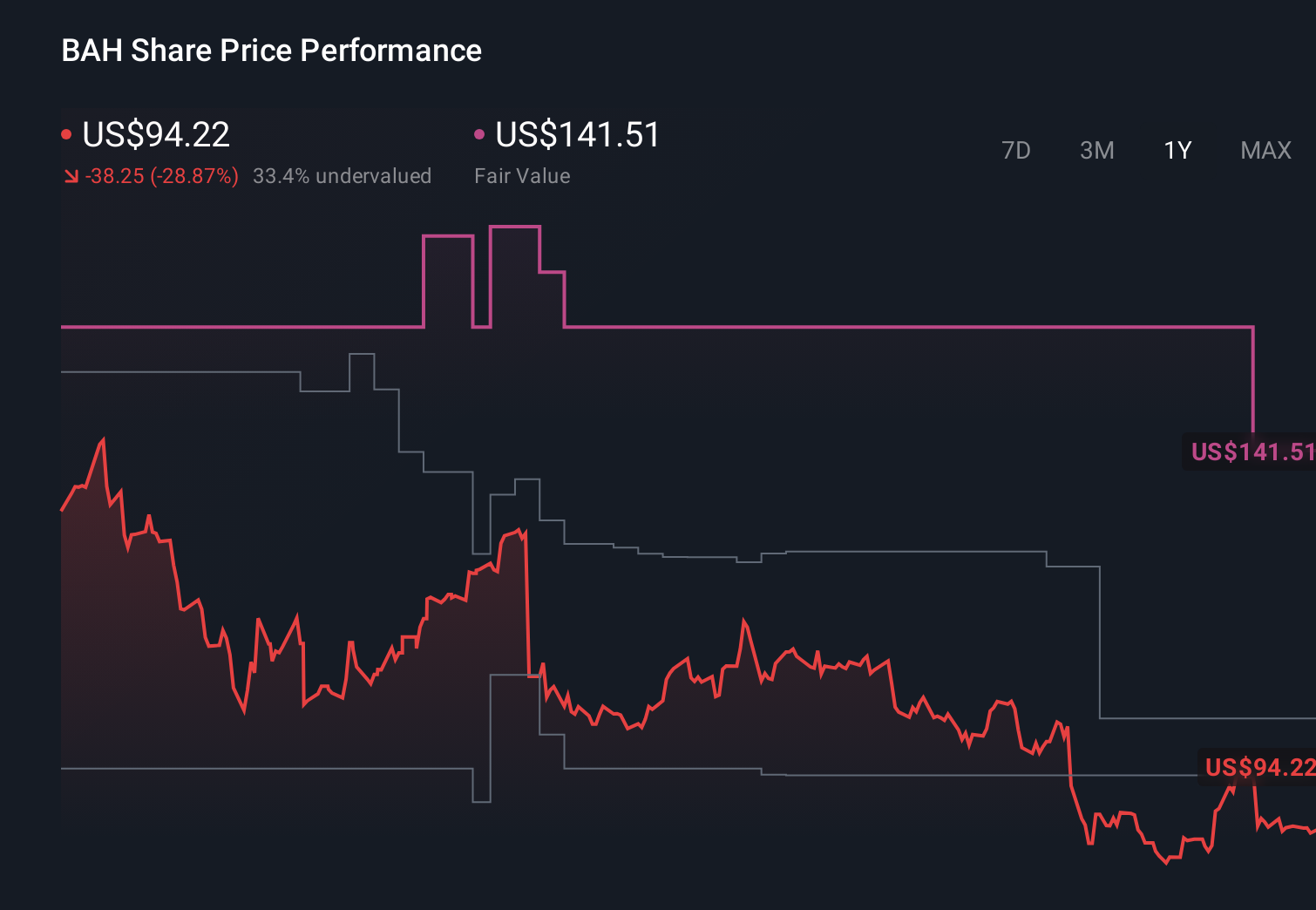

Valuation is complex, but we’re here to simplify it.

Discover if Booz Allen Hamilton Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com