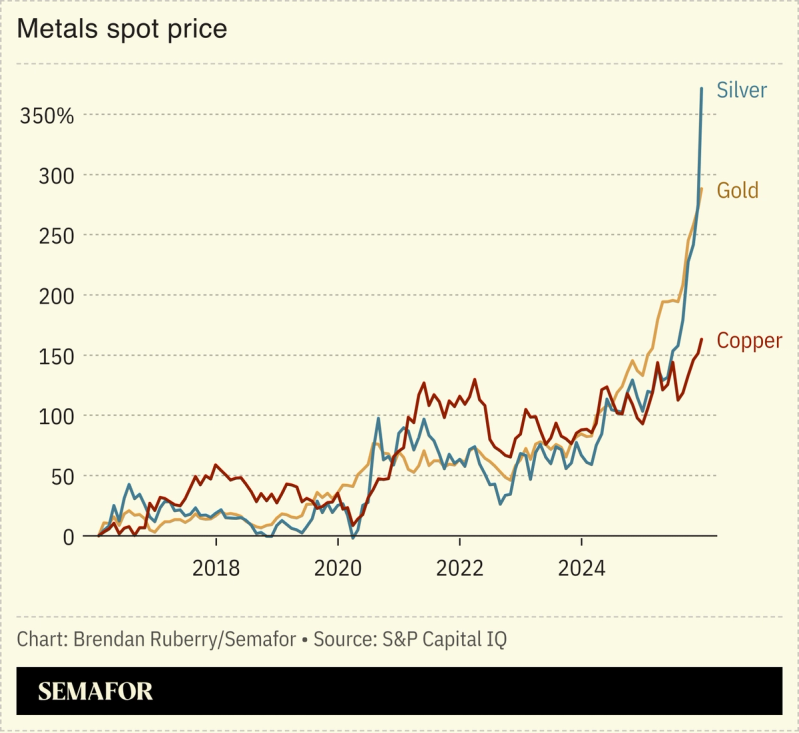

Gold and silver prices hit fresh highs on Monday as investors rushed toward safe havens amid end-of-year geopolitical tensions.

Washington’s blockade on Venezuelan oil triggered the latest surge, analysts said, along with bets on US interest rate cuts. Gold has become “the ultimate hedge against further uncertainty,” one money manager said, as investors this year fretted over US President Donald Trump’s tariffs and his attacks on the Federal Reserve’s independence.

Wall Street strategists are bullish about 2026 — a consensus implying a boring year — but basing your investment strategy off that assumption “is roughly as helpful as consulting a fortune cookie,” a Bloomberg columnist argued: Markets are now shaped by “unknowable global forces… and great innovations.”