- Tuttle Capital launched the Meme Stock Income Blast ETF, ticker MEMY, on Cboe Global Markets on the Cboe exchange.

- MEMY targets meme stocks and uses options-based strategies aimed at generating income from volatility.

- The ETF structure ties social media sentiment in retail favorites to listed options activity on Cboe.

For BATS:CBOE, hosting MEMY adds another ETF linked to heavily traded retail names and options contracts. Cboe Global Markets runs exchanges for equities, options, and ETFs, and products tied to popular trading themes can influence order flow and product mix. Meme stocks and options have been a focal point for retail traders, and MEMY sits at that intersection.

If MEMY draws consistent activity, it could contribute to trading volumes in both the underlying stocks and related options on Cboe venues. For investors watching BATS:CBOE, the launch is another data point in how the company responds to new trading trends and tests demand for specialized ETFs built around retail behavior and volatility.

Stay updated on the most important news stories for Cboe Global Markets by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Cboe Global Markets.

How Cboe Global Markets stacks up against its biggest competitors

Advertisement

Quick Assessment

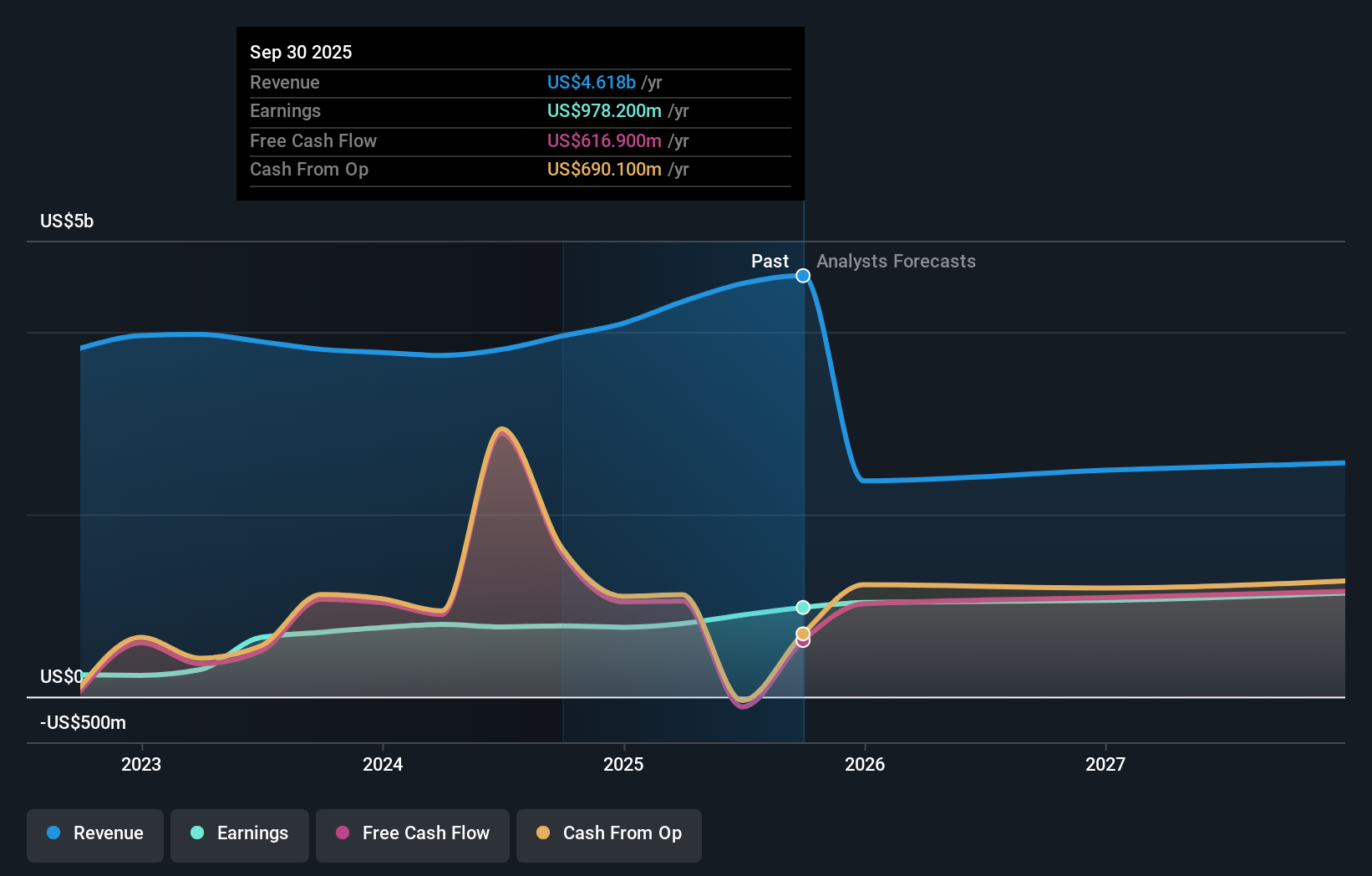

- ❌ Price vs Analyst Target: At US$273.07, Cboe trades slightly above the US$270.62 analyst target midpoint.

- ❌ Simply Wall St Valuation: Shares are flagged as overvalued, trading about 32.4% above estimated fair value.

- ✅ Recent Momentum: The 30 day return of roughly 8.4% shows positive short term momentum.

Check out Simply Wall St’s

in depth valuation analysis for Cboe Global Markets.

Key Considerations

- 📊 The MEMY launch ties Cboe even more closely to retail trading themes and options activity. This could affect how its business mix develops over time.

- 📊 Watch trading volumes in MEMY, related meme stocks, and Cboe option contracts to gauge how much this product resonates with retail flows.

- ⚠️ Concentration in products linked to highly volatile meme stocks can add revenue variability if investor interest in this theme cools quickly.

Dig Deeper

For the full picture including more risks and rewards, check out the

complete Cboe Global Markets analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com