- Cboe Global Markets announced that its clearing house, Cboe Clear Europe, achieved a key milestone by onboarding BNY as the first Agent Lender to clear Securities Financing Transactions (SFTs) for UCITS clients and introduced a title transfer model tailored for these clients.

- This expansion positions Cboe to extend its SFT clearing services to a broader range of securities and jurisdictions, reflecting increased institutional engagement and product innovation.

- We’ll examine how Cboe’s partnership with BNY on UCITS SFT clearing could impact its global growth ambitions and investment outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Advertisement

Cboe Global Markets Investment Narrative Recap

At its core, being a Cboe Global Markets shareholder means believing in the growth of global derivatives and securities trading, plus the company’s ability to expand services in new geographies and asset classes. The BNY and UCITS SFT clearing partnership is a forward-looking move, but on its own, it doesn’t materially shift Cboe’s biggest short-term catalyst, continued surges in trading and clearing volumes, or lessen the most immediate risk around index options franchise concentration.

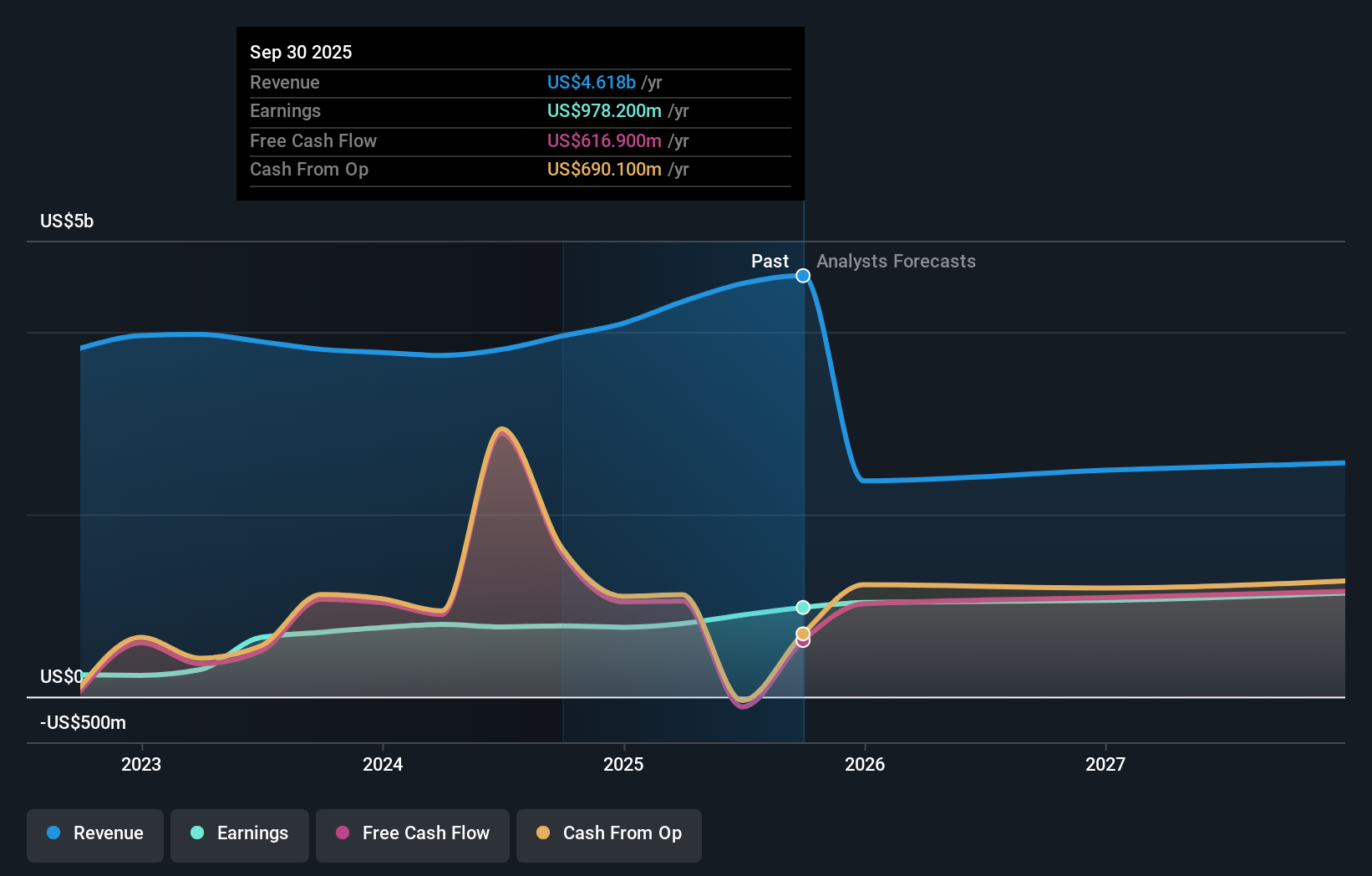

Of Cboe’s recent announcements, the Q3 2025 earnings release is most relevant in the wake of this news: revenue and earnings continued to climb, and profit margins improved, supporting the thesis that global diversification and next-generation clearing efforts can drive sustained growth. This momentum strengthens the catalyst of higher transaction-based revenue, yet a key question remains around…

Read the full narrative on Cboe Global Markets (it’s free!)

Cboe Global Markets is expected to generate $2.6 billion in revenue and $1.1 billion in earnings by 2028. This forecast implies a 16.9% annual revenue decline and a $203.7 million increase in earnings from the current $896.3 million.

Uncover how Cboe Global Markets’ forecasts yield a $250.62 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span US$41.96 to US$250.63, highlighting sharply contrasting outlooks. With global competition intensifying, your own assessment of future margins and market share may differ significantly from the crowd, explore several perspectives to inform your view.

Explore 8 other fair value estimates on Cboe Global Markets – why the stock might be worth less than half the current price!

Build Your Own Cboe Global Markets Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cboe Global Markets research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Cboe Global Markets research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Cboe Global Markets’ overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com