- If you are wondering whether Cboe Global Markets is priced attractively right now, it helps to step back and look at both the recent share performance and what current valuation metrics are actually saying.

- The stock last closed at US$270.60, with a 1.7% decline over the past week, a 1.4% return over the past month, 9.1% year to date, 31.5% over 1 year, 121.8% over 3 years and 191.5% over 5 years.

- Recent news coverage has focused on Cboe Global Markets’ role as a major exchange operator and provider of trading and data services. This keeps investor attention on how its platform is being used by market participants. This context is important when thinking about what might be priced into the shares today and how investors are reacting to changing activity across markets.

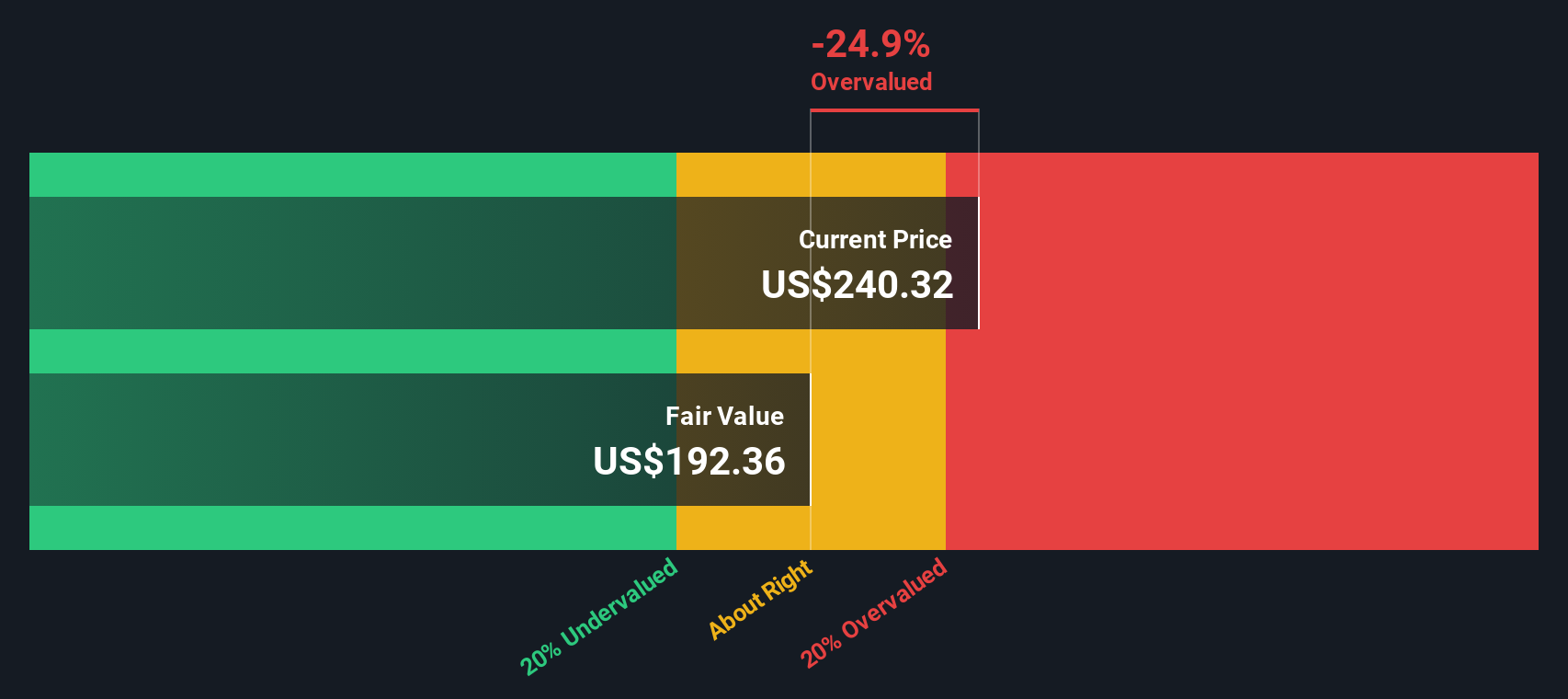

- Our valuation checks currently give Cboe Global Markets a value score of 0 out of 6. Next, we will walk through the main valuation approaches that feed into this score and then finish with a way to think about valuation that goes beyond any single model.

Cboe Global Markets scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Advertisement

Approach 1: Cboe Global Markets Excess Returns Analysis

The Excess Returns model looks at how effectively a company is using shareholders’ equity to generate earnings above its estimated cost of equity. Rather than focusing on cash flows, it asks whether each dollar of equity is pulling its weight and then capitalizes those excess earnings into an intrinsic value per share.

For Cboe Global Markets, the model uses a Book Value of US$49.08 per share and a Stable EPS of US$13.40 per share, based on weighted future Return on Equity estimates from 4 analysts. The Average Return on Equity is 20.80%, while the Cost of Equity is US$5.13 per share, which implies an Excess Return of US$8.26 per share. The Stable Book Value input is US$64.43 per share, sourced from weighted future Book Value estimates from 2 analysts.

Combining these inputs, the Excess Returns framework arrives at an intrinsic value of about US$245.67 per share. Compared with the recent share price of US$270.60, this implies the stock is around 10.1% overvalued on this measure.

Result: OVERVALUED

Our Excess Returns analysis suggests Cboe Global Markets may be overvalued by 10.1%. Discover 55 high quality undervalued stocks or create your own screener to find better value opportunities.

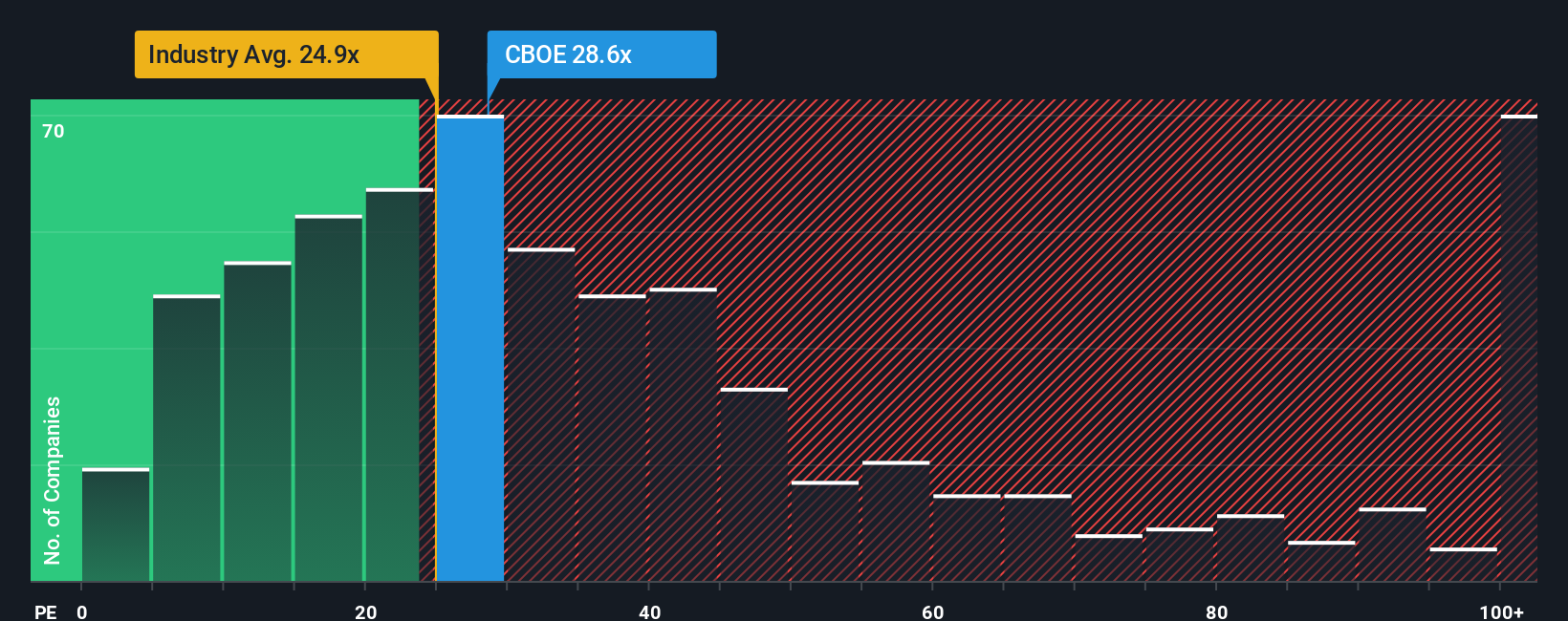

Approach 2: Cboe Global Markets Price vs Earnings

For a profitable company like Cboe Global Markets, the P/E ratio is a useful way to think about what you are paying for each dollar of earnings. It is simple to compare across peers in the same industry and it ties directly to the earnings figure that most investors watch closely.

What counts as a “normal” P/E depends on how the market views a company’s growth prospects and risk. Higher expected earnings growth or lower perceived risk can support a higher multiple, while slower growth or higher risk usually call for a lower one.

Cboe Global Markets currently trades on a P/E of 25.86x. That sits above both the Capital Markets industry average P/E of 22.11x and the peer group average of 24.83x. Simply Wall St’s Fair Ratio for Cboe Global Markets is 15.09x, which is a proprietary estimate of what the P/E might be given its earnings growth profile, margins, industry, market value and risk characteristics.

The Fair Ratio aims to be more tailored than a simple peer or industry comparison because it adjusts for differences in growth, profitability, risk and size. Comparing 15.09x to the current 25.86x suggests the shares trade well above this Fair Ratio based on these inputs.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Cboe Global Markets Narrative

Earlier we mentioned that there is an even better way to think about valuation, and that is through Narratives. Narratives let you set a story for Cboe Global Markets by pairing your view of its future revenue, earnings and margins with your own fair value estimate. You can then link that story to a live forecast on Simply Wall St’s Community page so you can see at a glance whether your Fair Value sits closer to a more cautious view around US$201 per share or a more optimistic view around US$662 per share. You can compare both to the current price to decide if you think the stock looks cheap or expensive, and have your Narrative update automatically as new news or earnings arrive.

For Cboe Global Markets however, we will make it really easy for you with previews of two leading Cboe Global Markets Narratives:

🐂 Cboe Global Markets Bull Case

Fair value: US$273.00 per share

Implied discount to this fair value: about 1% based on the last close of US$270.60

Modeled revenue growth rate: 16.07%

- Analysts frame Cboe Global Markets as benefiting from expansion in derivatives, data and global trading, with recurring, higher margin data services adding stability to the revenue mix.

- The narrative focuses on international growth, technology investment and business reshaping to support higher margins, while pointing to index partnerships, competition and new technologies as key risks.

- The consensus price target of about US$247.47 sits only modestly above one earlier share price reference and is tied to specific assumptions for 2028 revenue, earnings, margins and a P/E of 29.1x.

🐻 Cboe Global Markets Bear Case

Fair value: US$201.42 per share

Implied premium to this fair value: about 34% based on the last close of US$270.60

Modeled revenue growth rate: 3.18%

- This narrative relies heavily on two stage DCF and dividend discount models, with a focus on discount rate choices, cash flow growth assumptions and the company’s mix of equity and debt funding.

- It highlights Cboe Global Markets’ role as a large exchange group with low reported beta, consistent cash generation and a history of dividend increases, then tests a range of intrinsic value outcomes under different growth and discount rate settings.

- The work sets out detailed free cash flow and dividend paths, along with updated fair value estimates, to argue that the current price sits well above one modeled fair value point of US$201.42 per share using a revenue growth rate of 3.18% and a discount rate of 7.60%.

Taken together, these two narratives give you a structured way to decide which story feels closer to your own expectations for Cboe Global Markets’ revenues, margins and suitable valuation multiples at today’s price.

Do you think there’s more to the story for Cboe Global Markets? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com