- If you are wondering whether Cboe Global Markets is fairly priced or not, its recent share performance and current valuation metrics make it a stock many investors are taking a closer look at.

- The share price recently closed at US$250.09, with returns of 0.8% year to date and 31.1% over the past year, in addition to a very large 5 year gain that works out to roughly 2.8x.

- Recent news coverage has focused on Cboe’s role as a major global exchange operator and its position in options, volatility products, and related trading services. This context helps frame how investors are thinking about the company and may help explain why the stock has moved the way it has over the last few years.

- Cboe Global Markets currently scores 1 out of 6 on Simply Wall St’s valuation checks, so we will look at what traditional methods like P/E, multiples and cash flow models are saying about the stock, then finish with a more complete way of thinking about value that pulls those pieces together.

Cboe Global Markets scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Advertisement

Approach 1: Cboe Global Markets Excess Returns Analysis

The Excess Returns model looks at how much profit a company is expected to earn on its equity above the return that investors typically require, then converts those “excess” profits into an estimated per share value.

For Cboe Global Markets, the model uses a Book Value of $46.68 per share and a Stable EPS of $12.00 per share, based on weighted future Return on Equity estimates from 5 analysts. The Average Return on Equity is 20.60%, while the Cost of Equity is $4.80 per share. That leaves an Excess Return of $7.21 per share, which is the portion of earnings above the required return.

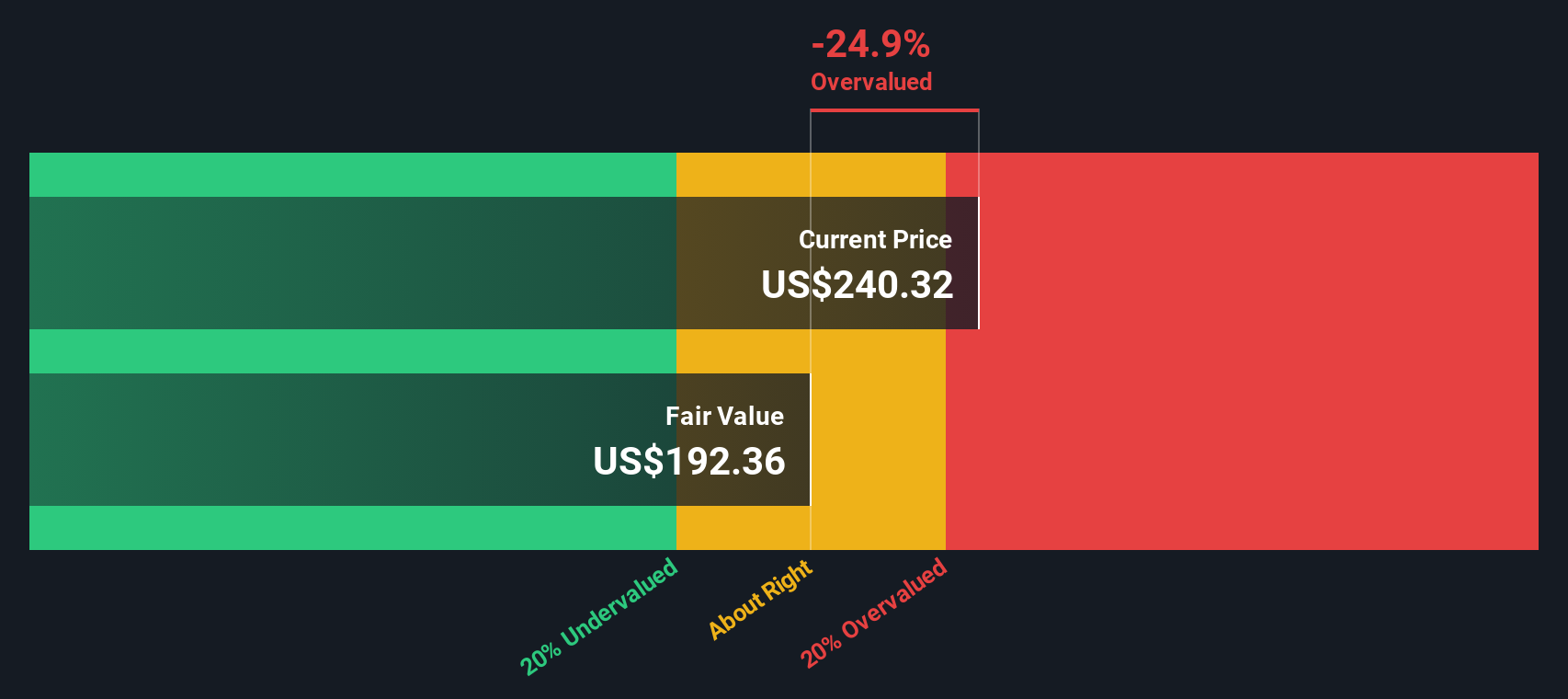

The Stable Book Value input of $58.28 per share, sourced from 2 analysts, is combined with these excess returns to arrive at an intrinsic value estimate of about $203.36 per share under this model. Compared with the recent share price of US$250.09, the Excess Returns valuation implies the stock is about 23.0% overvalued on this basis.

Result: OVERVALUED

Our Excess Returns analysis suggests Cboe Global Markets may be overvalued by 23.0%. Discover 877 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Cboe Global Markets Price vs Earnings

P/E is a common way to value profitable companies because it links what you pay for each share directly to the earnings that each share generates. It gives you a quick sense of how much the market is willing to pay today for one unit of current earnings.

What counts as a “normal” P/E depends a lot on expectations and risk. Higher expected earnings growth or lower perceived risk can justify a higher P/E, while lower expected growth or higher risk usually points to a lower multiple being more reasonable.

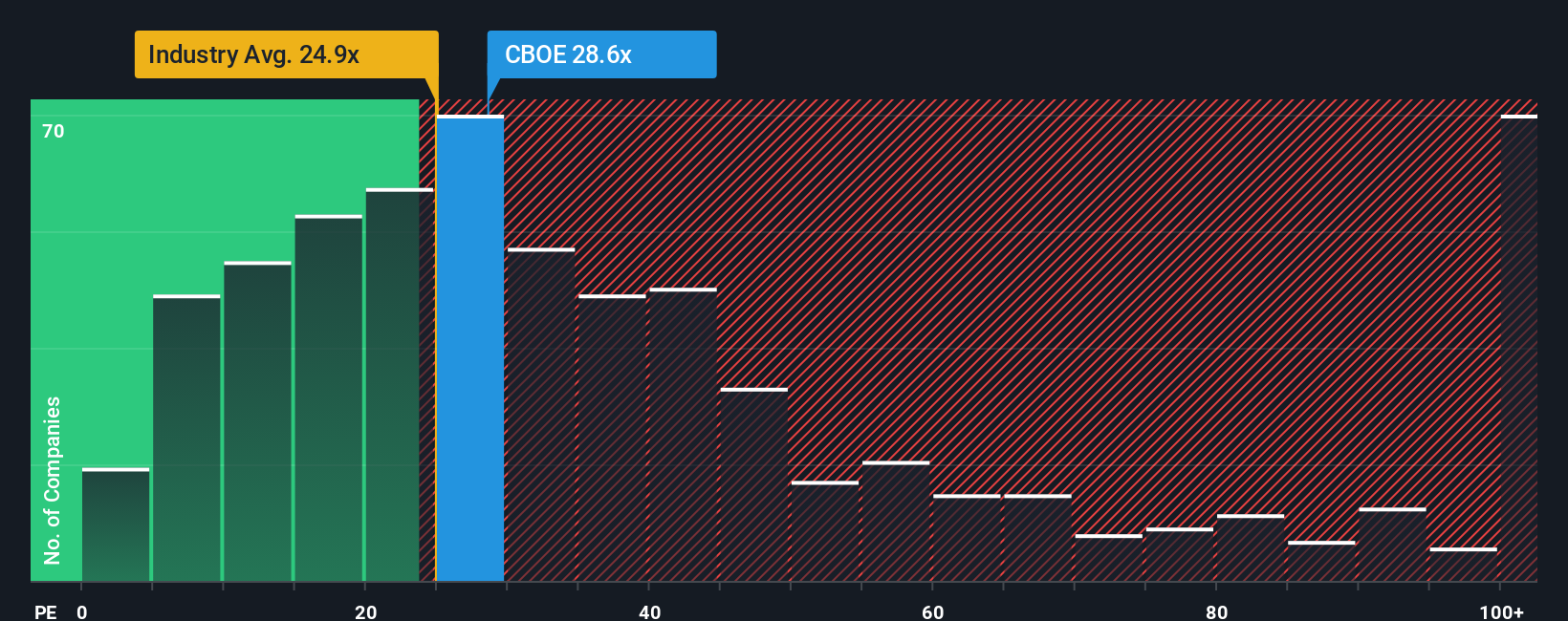

Cboe Global Markets currently trades on a P/E of 26.75x. That sits slightly above the Capital Markets industry average P/E of 25.75x, and below a peer group average of 31.81x. Simply Wall St’s “Fair Ratio” for Cboe Global Markets is 15.09x. This is a proprietary estimate of what the P/E could be given factors like the company’s earnings profile, profit margins, risk characteristics, industry and market cap.

This Fair Ratio can be more informative than a simple comparison with peers or the industry because it adjusts for those company specific factors rather than assuming all firms deserve similar multiples. With the current P/E of 26.75x sitting well above the Fair Ratio of 15.09x, this approach points to the shares looking overvalued on a P/E basis.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cboe Global Markets Narrative

Earlier we mentioned that there is an even better way to think about valuation. On Simply Wall St that comes through Narratives, which let you set out your own story for Cboe Global Markets by linking your assumptions on future revenue, earnings, margins and fair value to a clear forecast. You can then compare that Fair Value to the current price to decide if the stock fits your approach, and automatically update that view as fresh news or earnings arrive. One investor might build a Narrative around the higher fair value of about US$262 with confidence in upcoming product launches and data revenues. Another might lean toward the more cautious US$216 view. You can explore these different takes on the Community page and decide which story best matches your expectations.

Do you think there’s more to the story for Cboe Global Markets? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com