By Katrina Hamlin

Brussels risks overplaying its hand with China Inc. The European Union is mulling mandating companies to share technology and know-how in exchange for the opportunity to invest in the region, the EU trade chief and Denmark’s foreign minister said on Tuesday. But such schemes have a mixed track record and might drive away the Chinese.

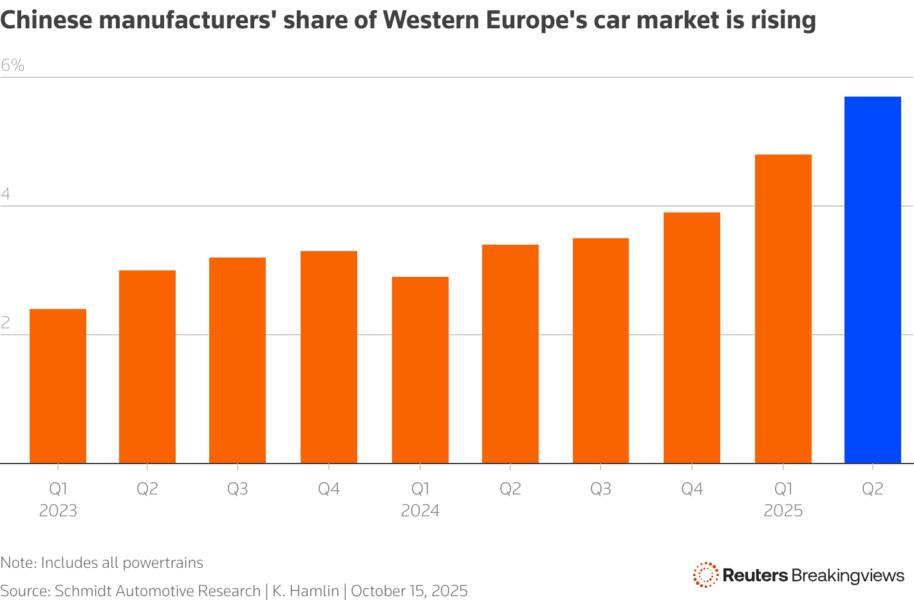

The aim of the protectionist plan is to prevent Chinese manufacturing giants from “overwhelming” the continent’s industries, per Bloomberg, citing sources. On paper, Europe should have leverage, particularly in autos: EU car sales topped 10 million last year. Taking a share is attractive for Chinese brands like BYD 002594,

002594 and Geely Automobile

175 who face overcapacity and a price war at home.

Moreover, China itself has shown that technological transfers can sometimes succeed. The country’s own high-speed railway benefitted from joint ventures with companies from Alstom ALO and Siemens

SIE, for example. Apple

AAPL devoted resources into developing an entire manufacturing supply chain that has turned the People’s Republic into an electronics powerhouse today.

However, the country’s auto industry is a cautionary tale. Although China now allows manufacturers to set up factories alone, for decades the world’s largest carmakers, including Volkswagen VOW and Toyota

7203, were only allowed to enter China if they formed joint ventures with state-backed players like Dongfeng Motor

489 and Guangzhou Auto. Yet these firms have failed to become competitive both globally and domestically; only three state-backed companies are among China’s top ten by sales of gas guzzlers today; the same holds true for EVs.

Beijing is also fiercely protective of its national champions. Last year, China’s Ministry of Commerce met with 12 automakers and advised them to use strategies such as merely assembling autos overseas to avoid unintentionally divulging their secrets, Bloomberg reported, citing sources.

As in the case of Apple in China, some level of tech transfer can happen without the government forcing things. A heavy-handed approach also risks a costly confrontation. Chinese foreign direct investments into the EU and the UK topped 10 billion pounds last year, up 47%, per Rhodium Group. A more effective plan for Brussels may be to encourage Chinese firms to invest and develop in European supply chains and manufacturing know-how.

Follow Katrina Hamlin on Bluesky and Linkedin.

CONTEXT NEWS

The European Union is looking into setting preconditions for Chinese companies investing in Europe, including transfers of technology and know-how, the EU trade chief and Denmark’s foreign minister said on October 14.

Enforcing joint ventures is another option under consideration, Bloomberg reported on the same day, citing sources.