- Ever wondered if Marvell Technology is a hidden bargain or if the current price is already baking in all the upside? Let’s break it down together, so you can feel confident about what you’re getting for your money.

- The stock’s price has barely budged this year, with a modest 0.8% gain over the last 12 months. Longer-term returns of over 120% in the past three years suggest there is real momentum behind the name.

- Recent headlines have focused on Marvell’s strategic moves in data infrastructure and AI partnerships, which have caught investor attention and could explain the stock’s recent swings. There has also been buzz around industry demand trends, making it even more important to assess what’s factored into today’s price.

- Right now, Marvell scores 1 out of 6 on our valuation checks, so it’s worth digging into why that is and which valuation method really gets to the heart of what Marvell is worth, especially given a new approach we’ll reveal at the end.

Marvell Technology scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Advertisement

Approach 1: Marvell Technology Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company’s future cash flows and then discounting them back to today’s value. This provides an estimate of the company’s fundamental worth. This method is especially useful for companies with significant expected growth in free cash flow, as it incorporates future potential into today’s valuation.

For Marvell Technology, the reported Free Cash Flow for the last twelve months is approximately $1.48 billion. Analysts estimate that annual Free Cash Flow could reach about $4.23 billion by 2030, with figures beyond the next five years based on historical trends and analyst consensus. This outlook underscores the expectation of strong earnings expansion over the next decade.

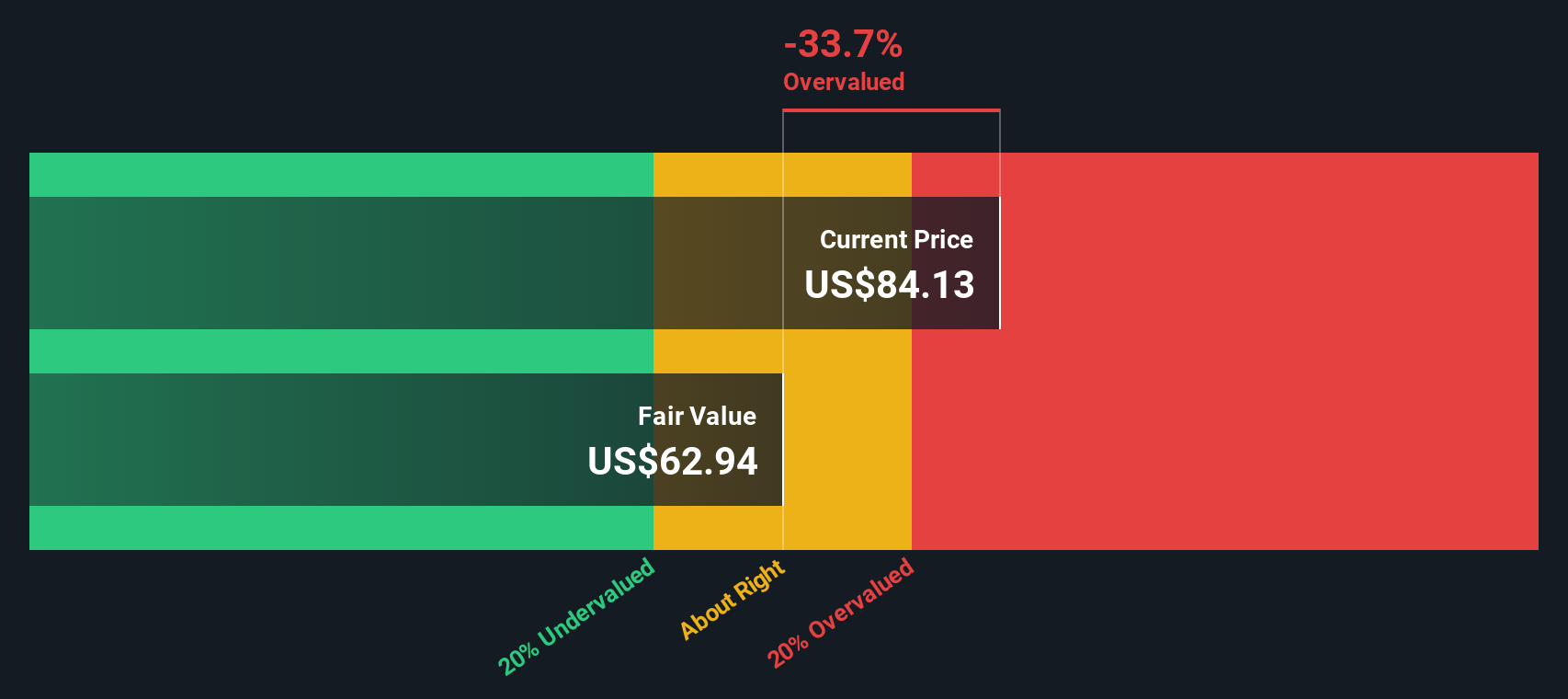

Based on the DCF calculation, Marvell’s intrinsic value is estimated at $60.38 per share. However, with the stock currently trading about 45.1 percent above this level, the DCF model suggests the share price is considerably overvalued compared to its underlying cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Marvell Technology may be overvalued by 45.1%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Marvell Technology Price vs Sales

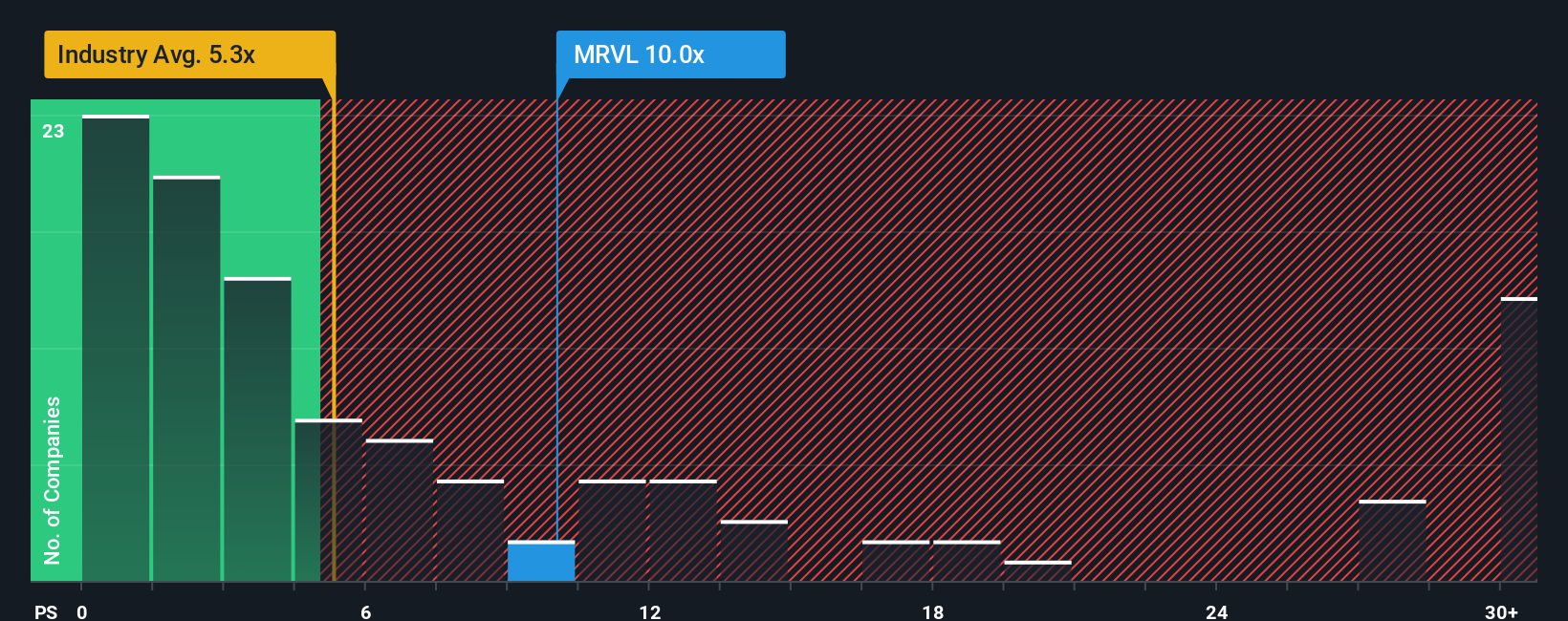

For companies like Marvell Technology that are reinvesting for growth or not currently profitable, the Price-to-Sales (P/S) ratio is a popular valuation metric. The P/S ratio allows investors to compare the stock price to the company’s top-line sales, which can be more revealing than looking at earnings when profits are lumpy or negative. This is especially useful for technology businesses in rapidly evolving industries, where strong revenue growth can precede sustainable profits.

The P/S multiple that is considered “reasonable” depends partly on how quickly a company is expected to grow its sales and how risky it is. Higher growth rates and lower risks can justify higher P/S ratios. Companies facing slowdowns or greater uncertainty tend to trade at lower multiples.

Currently, Marvell Technology trades at a P/S ratio of 10.4x. For comparison, the semiconductor industry average is 4.9x, while similar peers come in at 10.2x. Simply Wall St’s proprietary Fair Ratio for Marvell, which incorporates not only sales growth and industry factors, but also profit margin, size, and unique risks, stands at 11.5x. This Fair Ratio offers a more tailored benchmark than broad industry or peer comparisons because it accounts for Marvell’s individual growth outlook and risk profile rather than assuming one size fits all.

With Marvell’s actual P/S multiple just below the Fair Ratio, the shares appear reasonably valued based on sales. While higher than the industry, the premium looks justified given Marvell’s growth factors and risk profile.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Marvell Technology Narrative

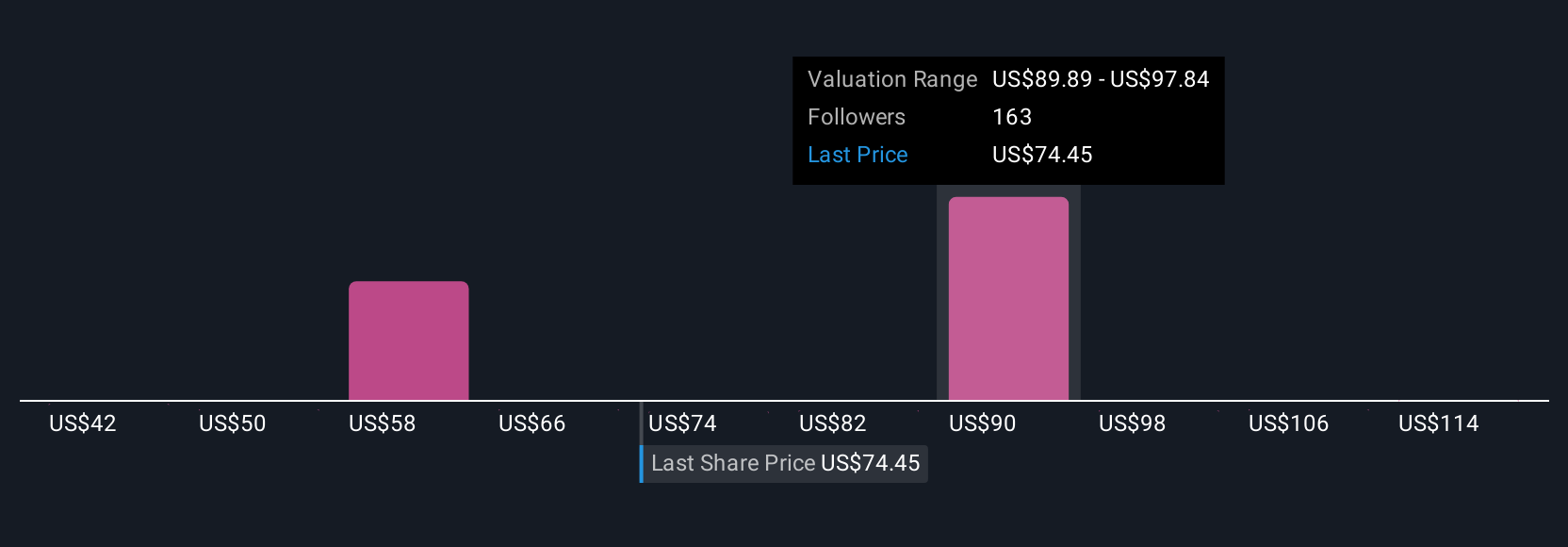

Earlier we mentioned there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, connecting the headlines with the numbers. You outline your perspective on Marvell’s future by setting your own estimates for revenue growth, profit margins, and risk. Narratives bridge the gap between what’s happening in the business and how that translates financially, making it easy to turn your viewpoint into a projected fair value.

This approach is both powerful and accessible. On Simply Wall St’s Community page, millions of investors are already using Narratives to clarify their thinking, compare ideas, and make smarter decisions. Narratives let you instantly see whether your own valuation lines up with the current share price, helping you decide if now is the right time to buy, hold, or sell. They also update automatically as new earnings or news arrives, so your assessment always stays relevant.

For Marvell Technology, one investor might believe earnings could soar with AI adoption and set a higher fair value, while another sees risks in data center exposure and prefers a much lower target. Your Narrative turns your research into action dynamically as the story unfolds.

Do you think there’s more to the story for Marvell Technology? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com