- PAR Technology (NYSE:PAR) has agreed to acquire Bridg, a customer data and shopper intelligence platform.

- The deal is intended to integrate identity resolution and customer analytics into PAR Technology’s existing restaurant and retail solutions.

- The acquisition focuses on connecting in store and online transaction data to support more targeted marketing and loyalty programs.

PAR Technology operates as a provider of software, hardware, and services for restaurant and retail operators, with a focus on point of sale and loyalty tools. By adding Bridg’s shopper intelligence capabilities, the company is looking to deepen its role in how merchants understand and interact with guests across channels. For investors, this adds another layer to PAR’s data story within an industry that is increasingly focused on personalization and digital engagement.

Looking ahead, the key questions are how smoothly Bridg’s technology is integrated into PAR’s platform and how quickly customers adopt the combined offering. You may want to watch for updates on customer wins, product roadmap progress, and how PAR explains the role of data and analytics in its long term strategy.

Stay updated on the most important news stories for PAR Technology by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on PAR Technology.

How PAR Technology stacks up against its biggest competitors

Advertisement

Quick Assessment

- ✅ Price vs Analyst Target: At US$26.21 versus a consensus target of US$59.11, the share price sits roughly 56% below analyst expectations.

- ✅ Simply Wall St Valuation: The stock is described as trading 58.9% below an estimated fair value, which screens as undervalued.

- ❌ Recent Momentum: The 30 day return of about 27.8% decline shows weak short term sentiment despite the Bridg acquisition news.

Check out Simply Wall St’s

in depth valuation analysis for PAR Technology.

Key Considerations

- 📊 The Bridg deal pushes PAR Technology further into data and customer analytics, which could be important for how deeply it embeds with restaurant and retail clients.

- 📊 Watch how management quantifies revenue from data driven products, progress on integrating identity resolution, and any commentary on cross selling Bridg into the existing base.

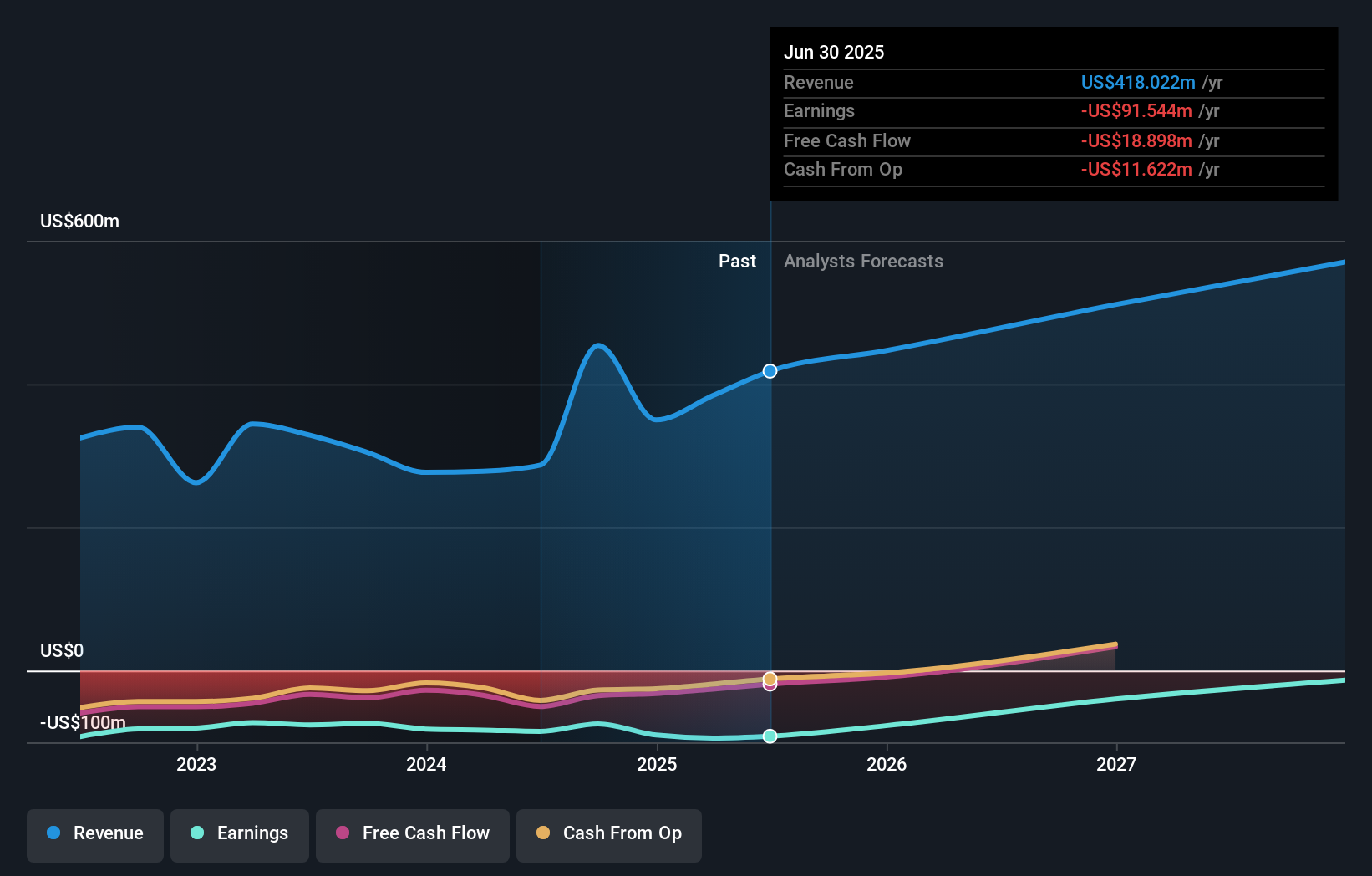

- ⚠️ The company is currently loss making and not assessed as moving to profitability over the next 3 years, so added integration and investment costs around Bridg matter for cash burn.

Dig Deeper

For the full picture including more risks and rewards, check out the

complete PAR Technology analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com